Serviços Personalizados

Journal

Artigo

Indicadores

-

Citado por SciELO

Citado por SciELO -

Acessos

Acessos

Links relacionados

-

Similares em

SciELO

Similares em

SciELO

Compartilhar

Revista de Gestão Costeira Integrada

versão On-line ISSN 1646-8872

RGCI vol.15 no.3 Lisboa set. 2015

https://doi.org/10.5894/rgci559

ARTICLE / ARTIGO

Benefit maximizing criteria from the Nigerian Coastal and Inland Shipping Cabotage Policy*

Critérios de maximização de benefícios da política nigeriana de cabotagem

Chinedum Onyemechi@, 1

@Corresponding author to whom correspondence should be addressed. e-mail: <c_onyemechi@yahoo.com>

1Federal University of Technology, Department of Maritime Management Technology, Owerri, Nigeria.

ABSTRACT

This paper reviews government policies of developing maritime nations affecting investments in ship sizes operating in lakes, rivers canals, Inland waters and coastal waters of these maritime states. The Nigerian cabotage policy was specially reviewed in this work, picking out loopholes and areas of possible co-operation with ship investment organizations from the developed maritime nations. Opportunities in the West African nation’s transportation network were identified from a careful study of the nation’s internal water network, rich mineral deposits, oil and gas reservoirs, emerging coastal cities and hinterland commercial nerve centre. Strategic investment options for the global investor shipping firms with other African countries which use the cabotage were identified in the cabotage policy framework. Applied analytical models include benefit/cost analysis, real – options investment analysis, SWOT analysis welfare analysis of MARPOL compliant river crafts. Vessel types for which analysis were carried out include passenger vessels, bunkering vessels, fishing trawlers, barges, tugs dredgers, tankers (coast wise) marine mining vessels, waste disposal vessels, carriers (short sea non cargo vessels), and lighters.Identified strategic management options include the merger option, strategic alliances, joint venture strategies.

The experience of the foreign ship operator in the region was identified as a major advantage in the globalization of the river, and coastal size vessel operating companies. The implications of their participation in the Nigerian cabotage policy were also highlighted. Emerging areas in the cabotage rule in world affairs were also identified.

Keywords: Exclusive Economic Zone; Cargo Protection; SWOT Analysis; Joint Ventures; Offshore Support Vessels.

ABSTRACT

Este trabalho revisa as políticas governamentais de desenvolvimento de nações marítimas que afetam os investimentos na dimensão de navios que operam em lagos, canais fluviais, águas interiores e águas costeiras desses estados marítimos. É especialmente focada a política de cabotagem nigeriana, identificando lacunas e áreas de possível cooperação com as organizações investidoras das nações marítimas mais desenvolvidas.Foram identificadas oportunidades nas redes de transportes dos países oeste-africanos a partir de um estudo cuidadoso das redes aquaviárias, dos depósitos minerais mais importantes, dos reservatórios de petróleo e gás, e das cidades litorâneas e do interior que constituem centros comerciais nevrálgicos. No quadro da política de cabotagem foram identificadas opções estratégicas de investimento para as empresas globais de navegação. Os modelos analíticos aplicados incluem análise de custos / benefícios, análise de investimentos, análise SWOT de bem-estar, análise da MARPOL compatíveis com embarcações fluviais. Os tipos de navios considerados incluem navios de passageiros, navios de abastecimento, traineiras de pesca, barcaças, rebocadores, dragas, navios-tanque, navios mineraleiros marinhos, navios de eliminação de resíduos, navios transportadores (de curta distância, não de carga) e navios ligeiros. As opções estratégicas de gestão identificadas incluem a fusão, alianças estratégicas, empreendimentos conjuntos (joint venture).

A experiência de operadores navais estrangeiros na região foi identificada como muito positiva na globalização do rio, e para as empresas de exploração de embarcações costeiras. Foram também destacadas as implicações de sua participação na política de cabotagem nigeriana, bem como as áreas emergentes de cabotagem no panorama dos negócios mundiais.

Palavras-chave: Zona Económica Exclusiva; Proteção de Carga; Análise SWOT; Joint Ventures; Embarcações de apoio offshore.

1. Introduction

Marine policy formulation is often viewed by developing maritime states as the key instrument to achieving ownership sufficiency in the carriage of a reasonable volume of her goods, arising from the trade. Two aspects of maritime venture have been affected by the maritime policies of governments in modern times. The first refers to the policy of nations affecting trade at the inter – continental level. A good example of this is the United States Merchant Marine Act of 1936 as amended, which spelt out the shipping policy interest of the American Nation, in covering major international marine routes with American vessels. This policy to a good extent has been copied to different levels of efficiency by developing maritime states.

The other maritime venture that is affected by government policy formulation is the inland water – ways and the exclusive economic zone now called the EEZ, or coastal waters of a state. Marine policy formulation of most developing maritime states takes the form of the imposition of a cabotage rule in her coastal waters. Under this regime, the ownership and management of vessels and crafts operating in the coastal waters is reserved for indigenes and registered corporations also owned by indigenes of the same state. This view can be termed, the rigid view, since experience has shown that these developing maritime states usually do not possess the capital in terms of sufficient number of ships to fulfil existing needs in the zone of the cabotage policy. A more relaxed view is often provided for in such policy documents allowing ships of other nations to operate in her cabotage waters pending the time such developing maritime nation attains self – sufficiency in her vessel ownership structure.

1.1. Objective / purpose of research

This paper sets out to investigate the following issues affecting the Nigerian coastal and Inland shipping cabotage policy:

(i) discover existing gaps in knowledge to which the policy makers did not give attention;

(ii) discover ways of maximizing accruable benefits from the policy; and

(iii) thirdly, the paper intends to review the historical aspects of the cabotage legislation and its influence on nations.

1.2. Significance of research

The research is aimed at discovering a new approach toward coastal and Inland shipping cabotage administration. It will also further co-operation and globalization in the administration of river crafts, coastal ro/ro short sea ships, fishing crafts, and other ships involved in rivers, lakes, canals and coastal shipping operations.

Ship management firms with experience in the above area thus, have an option to globalize in a bid to take advantage of the new relaxed cabotage regime of arising developing maritime nations.

2. The cabotage policy

2.1. History of the cabotage policy

The term cabotage is often used to refer to coastal navigation and trade operating between the ports of a given maritime nation, recognized by the laws or policies of that nation as being specially reserved to indigenous operators. Most laws requiring the practice of cabotage usually require these ships to be built and operated in such countries. This requirement which was set up in the Jones Act, (section 27 of the US Merchant Marine Act of 1920) has been adopted by many developing nations who do not have the resources to either build or run their own vessels. This has made the rigid adoption of the cabotage policy requirements impracticable to most developing countries, including Nigeria.

The United States is often seen as the origin of the cabotage policy in modern times. Most nations therefore implementing the cabotage policy tend to copy or adopt that of the United States. Some other legislation in the United States supporting cabotage include the Passenger Ship Act of 1886, the Towing Act of 1940, the Fisheries Conservation and Management Act of 1976 and the 1983 presidential proclamation which created a 200-mile EEZ around the United States.

2.1.1. The origin of cabotage

What might be described as the origin of the cabotage act cannot be the Jones Act of 1920, since cabotage was in practice before this time. Kendall (1986) seems to be saying something about this when he pointed out that in 1817, “the American Congress enacted a law, which restricted waterborne trade between the states to ships built, and owned in the United States.” The implementation of the 1817 act was found to have stimulated coastwise trade to ships operating between the US Atlantic coast and Gulf coasts.

The cabotage rule in principle affects only coastal trade. However, technically the underlying principle has been extended via other legislations to affect specific trades where the government of the nation has an interest. Cargo protection policies and ship subsidy practices may all have evolved out of this policy.

2.2. Cabotage, as practiced in other nations

2.2.1. Australia

In Australia, the practice of cabotage is covered under the Navigation Act 1912. Under the act, various forms of protection which are not available to foreign flag vessels are offered to indigenous flag ships. Australian indigenous vessels that operate permanently in Australian coastal trade are issued with a licence. Foreign flag vessels wishing to operate in the Australian coastal trade are issued either a single voyage permit or a continuous voyage permit by the department of transport and regional services (DOTARS) Webb (2004).

2.2.2. New trends

Some arguments in recent times have tended towards the emergence of a new domestic shipping policy. While some argue that the cabotage policy removes competitiveness in coastal shipping, others argue that it is no more relevant in the present age. Current issues in West Africa has added the issue of local content to further requiring foreign coastal operators in the region to pick up local partners before they can operate. This issue further strengthens cabotage operations in the region. The practice is found in Ghana, Nigeria, Angola and smaller West African countries.

Hodgson & Brooks (2004) for instance has preferred the dropping of the cabotage policy for the policy of non cabotage OECD nations like U.K. and Norway.

2.2.3. India

India presently practices cabotage policy in her domestic shipping, but however, a new proposal aimed at reversing the cabotage rule has been forwarded for cabinet approval. Under this new legal regime, vessels of neighboring countries to India will be allowed to sail in Indian coastal waters (Zadoo, 2005).

2.3. Cabotage integrated backwards

The cabotage principle is an aspect of the interventionist shipping policy. Other aspects of the interventionist shipping policy include subsidy policy, a regulation policy, taxation policy, and flag discrimination policy. Arguments often presented to justify the practice of the interventionist shipping policy includes

i. economic and military security argument

ii reduction of faith in the comparative advantage theory

iii retaliatory institutionalization of policy against other maritime nations, who practice it.

Some economic demerits have often been associated with interventionism, in international shipping. These include high freight rates, large operating costs, poor services and excess shipping capacity building.

Shipping policy rules have existed since the times of the Phoenicians many centuries before Christ in the Mediterranean region. Other early aspects of shipping policies include the rules of the Oleron , the Mare nostrum, etc. About the 17th century, Hugo Grotius then came up with his common heritage rule for the international waters, an axiom that has stood unchallenged to date. The introduction of cabotage and the EEZ concept, however, though tends to reduce the area of influence of Grotius common heritage rule.

2.4. The Nigerian Cabotage Act

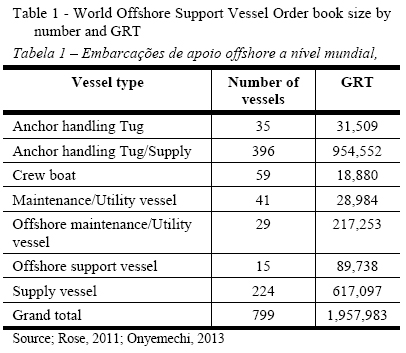

The number of vessel acquisitions at the global level is on the rise especially in the cabotage sector in which Nigeria is interested. This fact is captured in table 1.

The country should try to maximize her vessel acquisition to enable her fully participate in her local trade.

Nigeria’s Cabotage Act is known and referred to as the coastal and Inland shipping (cabotage) Act No 5 of 2003. It constitutes of nine different parts, which spells out its operating principles. The central theme of the Act however is reflected in parts II, part III, part IV and part V. Part II from its title deals with legislations that restricts vessels in domestic coastal trade to indigenously owned vessels.

Section 3 of part II of the Act unequivocally states; “A vessel other then a vessel wholly owned and manned by a Nigerian citizen, built and registered in Nigeria shall not engage in the domestic coastal carriage of cargo and passengers within the coastal territorial Inland waters, or any point within the waters of the exclusive economic zone of Nigeria.” This section in intent is aimed at attracting investments in ship construction of cabotage size vessels into Nigeria. This however is not stated directly in the Act. It can be seen as an Act aimed at benefiting ship construction interests operating in Nigeria. The above requirement is watered down in part III which provides for waivers to be granted by the Minister of transport to foreign shipping interests where he is satisfied that there is no wholly owned Nigerian vessel that is suitable to provide such service. Waivers may be granted by the minister in any of the following circumstances:

a. Where the shipping company operates a joint venture arrangement between Nigerian citizens and non – Nigerians, with the equity shareholding of Nigerians in the partnership or joint venture being not less then sixty percent (60%) and such percentage is held by Nigerians free from any trust or obligation favoring the non – Nigerian.

b. The vessel is registered in Nigeria, or

c. Is owned by a shipping company registered in Nigeria and complying to the relevant provisions of the cabotage Act.

Where a waivers is granted to any of the above, it shall last for a period of one year. Waivers is the subject of part III of the Act, while part IV focuses on conditions that permits a foreign – owned vessel being co-owned by Nigerians to apply for and receive a licence. In technical terms one may state without shaking, that in the instances given above, there exists a merger option for foreign shipping companies willing to co-operate with Nigerians, in the event that they decide to partake in our domestic trade.

Section 26 spells out conditions under which a mortgaged ship may partake of the cabotage law. Such a vessel must be under charter for a term, not less then 3 years. Again, the charterer or mortgagees must meet the citizenship requirements for operating vessels in the domestic coastal trade. Prior, to commencing operations, a charterer is required to produce an affidavit sworn to by the financial institutions lending him the money in a court of superior records, certifying that the financial institutions interest in the venture is solely financial, with no intent of contracting the vessels operation to non – citizens.

Part V of the Act require all vessels intended for use under the Act to be duly registered by the Registrar of Ships in the Special Registrar for Vessels and Ship Owning Companies engaged in cabotage. The following vessel types are eligible for registration under the Act as cabotage vessels.

(a.) Passenger vessels:

(b.) Crew boats

(c.) Bunkering vessels

(d.) Fishing trawlers

(e.) Barges

(f.) Off shore service vessels

(g.) Tugs

(h.) Anchor handling tugs and supply vessels

(i.) Floating petroleum storage

(j.) Dredgers

(k.) Tankers

(l.) Carriers, and

(m.) Any other craft used for carriage on, through the underwater of persons, property or any substance whatsoever.

In trying to register vessels for operation under the cabotage, the Minister may demand compliance to section 23 of the Act. This section require among others, vessels registrable to be beneficially owned by Nigerians or Nigerian registered companies or be a bareboat chartered vessel under charter by Nigerian citizens, being managed and controlled form Nigeria. Or otherwise, he should ensure that not more than 40 percent of the shares and control of the company accrue to non-citizens the vessel is also required to comply with both local and international conventions.

The rest of the parts are tributary to the above listed parts. Part I deals with interpretations, part VI with enforcement, part VII with offenses, part VIII with Cabotage Financing Fund and part IX with miscellaneous.

Enforcement officers are required to be appointed by the National Maritime Authority to enforce that Act. Offenses committed under that Act carry penalties ranging from N5, 000,000 to N15, 000,000. The presence of this rule has forced many foreign shipping firms operating in Nigeria to localize through joint venture partnerships with local companies. Good examples include the joint partnership between South Asian company Bumi Armada with a local company Century group. The joint company is known as Century Bumi. The other good example is the localization of the foreign shipping firm Lamnalco to AfrikDelta.

The Act places a surcharge of 2 percent of the contract sum performed by any vessel engaged in coastal trade, to be paid into the account of the National Maritime Authority and deposited in commercial banks, made available to Nigerian citizens and shipping companies wholly owned by Nigerians.

3. Methodology

The methods applied in the research include:

(a) SWOT analysis; this involved strength, weakness, opportunities, and threat analysis of the Nigerian cabotage Act.

(b) Benefit/ cost analysis; under this, criteria for benefit maximization rules in the cabotage policy were established.

4. Report of findings

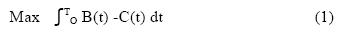

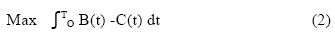

In the valuation of marine policy, one tool that has been very helpful is the social costing technique. Pillai and Paul(2011) In this approach the objective function may be set as follows:

Maximize social welfare, mathematically expressed as:

subject to constraints social benefits (B); and social cost (C)

The benefits are often reflected in social values while the costs are often viewed to reflect the opportunity cost of invested in such projects. For instance money spent in dredging a channel has the opportunity cost as , other projects that would have gulped the money. In ranking an investment with the benefit/cost ratio, the investment is seen as good if the B/C ratio is (greater than) > 1.

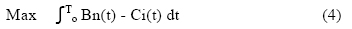

The above approach can be developed for use in analyzing the cabotage policy discussed above. The Nigerian coastal and inland shipping cabotage policy may be described as being hinged on the formula below.

with B(t), C(t) > O and where B(t) represents the total benefits expected to be derived from the policy, and C(t) the opportunity cost.

The benefits B(t) can be said to comprise two components:

a) Attract maximum shipbuilding capacity of cabotage size vessels into the country.

b) Maximize net attracted freight rates brought in by the cabotage policy.

4.1. Transfer of shipbuilding technology

In the first instance, where a foreign firm exercises an option of transferring her shipbuilding technology for cabotage size vessels, to Nigeria, a new benefit maximizing criteria incorporating the gains from (b) above will emerge. This is because vessels manufactured, by the corporation will have ready market assured by the cabotage policy, and outside Nigeria, in the international market. This is covered by the part of the policy which states that only vessels, built in Nigeria shall engage in domestic coastal trade.

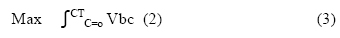

A mathematical function representing total benefits from this approach can be written under integral calculus as

subject to available market.

With Vbc representing vessel building capacity, and C=o to CT representing the whole range of cabotage size vessels available in the policy.

A second option which can be exercised as part of the first will be the location of the shipbuilding firm in the Nigeria Export Processing Zone (EPZ) area. This act will maximize accruable profits to the shipbuilding firm by minimizing the customs duties paid on imported materials.

Option (b) above if exercised will only affect the derivable freight rate earned through a merger, or joint venture relationship between a Nigeria firm and a foreign owned shipping firm.

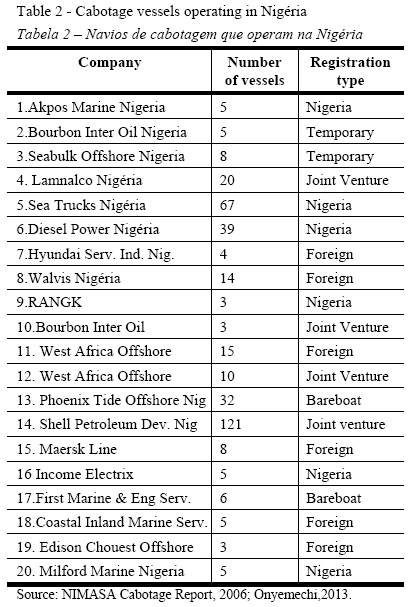

The number of vessels captured into the cabotage framework is visible through the following database (Table 2).

4.2. Merger or jointly owned shipping firms

Where a foreign firm decides to take advantage of the cabotage policy through merger or joint venture agreements, the following investment analysis will apply.

The first approach will affect situations where a new venture is supplied into the joint venture agreement. The benefit from such arrangement will be given by

where Bn represents the net derivable profit or net freight earnings from the joint venture agreement, and Ci(t) represent the invested capital or cost of construction of such vessel.

The range O to T represents the time frame for which the total number of vessels employed in the venture is expected to last.

In a second approach, a shipping firm abroad holds a joint venture agreement with a firm registered under the Nigerian cabotage law, in hope of transferring vessels billed for lay-up to such joint-venture company. In this situation the vessel continues to earn freight instead of paying port changes or berthage. The benefit derived from this second joint venture is thus multiplied or doubled.

4.3. Real-options valuation

This valuation principle assesses the effect of chances in determining return on capital invested. It divides the capital outlay into two components, the deterministic component taken care of by the discounted profit and a stochastic component taken care of by the mean of the standard deviation of the errors assessed over a given time period. Real option valuation is widely applied in shipping financial appraisal.

4.3.1 Nigerian coastal & adjacent river transportation networks

The transportation network in Nigeria's coastal waters can be subdivided into the following sub-sectors:

i) - Delta River network. This comprises of the rivers and creek networks around the oil and gas rich delta coastline of Nigeria. The region is a commercial nerve centre that houses major oil companies in the area. Major export bases like oil terminals, and harbors for both import and export goods are also based in this region. Marine transportation options in this region include oil supply vessels (O S V,s), fishing vessels, barge transport vessels, tugs, dredgers, coastal tankers, bunkering vessels, both company-owned and private crewboats, passenger vessels etc. The region is bounded by the newly declared 200-nautical mile Exclusive Economic zone (EEZ)-

ii) -The Exclusive Economic Zone. This region is currently a very active region with oil prospecting activities by major oil concerns like Shell Petroleum Development Company (SPDC), Exxon Mobil, Nigeria, Chevron /Texaco among others, fishing activities by both local and international companies, marine traffic by major international shipping lines, and air transportation by company-owned helicopters serving the major oil firms flying between rig & land base, etc. Also included are security operations by the Nigerian Navy and other agencies. Marine transportation options in this area covers all the cabotage size vessels and international vessels in other trades.

iii) - Imo river network, cross river network and creeks of Western Nigeria. These form navigable waterways for barge transportation, ferry services, and log transportation. Short sea ro/ro shipping services, hotel boats for tourism and fishing crafts are very good trade options in this region.

4.3.2. Emerging coastal cities & commercial nerve centres

A - Lagos

The largest of these cities is Lagos, a commercial nerve centre of trade & commerce, the largest Nigerian port city with major shipping lines located therein. The headquarters of major oil companies are also located here. Major operating fishing companies in the country are here. The headquarters of the National Maritime Authority is also located here.

B – Port Harcourt

This is the largest oil city in Nigeria. It has Shell's Oil Export terminal located at Bonny: The Nigeria LNG operations base is also located here. Other major oil corporations also operate from here. The city has a port as well as fishing terminals.

C - Warri

This is also an oil city. Major oil firms in this area are Chevron/Texaco operating from Escravos and Shell Petroleum Development Company of Nigeria, operating from Forcadoes terminal.

D - Calabar

This city houses the first Nigerian Export Processing Zone. It is an attractive port city and a commercial nerve centre. Exxon Mobil's terminal is located at Qua Iboe off Calabar.

E - Major commercial hinterland centres

These include Aba, a textiles base & industrial centre, Onitsha, a major importing city. Benin, Kaduna, Owerri, Ibadan, Kano, Umuahia among others.

4.3.3. Developed maritime nations & cabotage policy

An emerging opportunity for developed maritime nations trading in cabotage size vessels is dependent on how to maximize benefits from this present regime of cabotage polices. Opportunities in developing maritime nations operating the cabotage rule, should be sought out, and best strategies for enhancing such opportunities to the general benefit of all, evolved.

The Canadian experience in the great lake district and St Edwards water ways linking the Atlantic and interior Canadian cities is of a good advantage in this new era of global co-operation. Companies operating in this district may decide to globalize their activities by signing new joint venture agreements with Nigerian carries operating in the cabotage waters, in view of searching out new trade opportunities. Other developed countries in this category among others will include shipping operators in the United States, Japan, Britain, France, Norway, Australia etc.

4.4. SWOT analysis of the cabotage Act

The acronym SWOT means strengths, weaknesses, opportunities & threats. It is an analytical tool used in strategic management to evaluate and appraise policies of nations or corporate bodies. Here, we are going to identify the strengths and weaknesses, as well as the opportunities and threats associated with the cabotage policy.

4.4.1. Strengths

The strengths of the cabotage policy as practiced by Nigeria are founded on the following basic facts:

a) The ownership and control of activities in shipping at the coastal level will be in the hands of the indigenes that stand in a position to research, invest and thus improve shipping activities in their country.

b) The involvement of the indigenes will force the investment institutions such as banks to be interested in ship financing, hence stirring up and supporting development in this sub-sector of the economy.

c) The leadership position of the indigenes in this sub-sector will place them in a position to attract other foreign investors into the industry.

d) Individuals and corporate institutions may invest in shipbuilding and construction in the country in hope of utilizing the market offered by the cabotage policy.

e) A transfer of the shipbuilding technology from the attracted shipbuilding technology sector to the indigenes will occur.

f) More jobs will be created in the maritime sector, to the full benefit of indigenes trained in marine related activities.

g) The rate of growth of commerce in coastal shipping operations is expected to increase maximally.

4.4.2. Weaknesses

The weaknesses of the cabotage policy as practiced by Nigeria includes inter alia:

1. Ship repair facilities at the local level are presently poor. As such more energy should be focused in both human and facility development for both opera operations and repair if the Act is to make the necessary maximum impact on development.

2. The huge investments required to finance necessary shipping activities in the coastal sub-sector may not be available. Proper implementation of the policy at as a rigid rule would therefore be impossible. The absence of the necessary funds will thus force indigenes to resort to several joint venture agreements with owners who certainly come from more developed parts of the world. The rigid rule argument eliminates the participation of foreigners. This is not the case with Nigeria where the foreign operators have the option to localize through available local partnerships.

Existing foreign companies operating in the region will have to decide, either to comply with the requirements of the cabotage Act or pull out their resources. Presently, these companies are converting to local companies through available joint venture options made available in the Act.

4.4.3. Opportunities

Several dimensions of opportunities are created by the cabotage policy. These include:

a) The whole lot of shipping investment opportunities in the following areas; passenger vessels, crewboats, bunkering vessels, fishing trawlers, barges, offshore service vessels, tugs of all types, dredgers, tankers, carriers, floating petroleum storage etc. are thus open for investment, by virtue of the Act.

b) The return on investments made in these areas most of which are valued in dollars will thus be open to both indigenous and foreign joint venture partners of indigenous investors, in the cabotage controlled trade.

c) A new market of investors through research will come to learn about opportunities in the area, thus stirring up further investments.

d) The Cabotage Vessel Financing Fund made available to indigenes by the policy will thus enhance their position to participate in the lucrative business of shipping.

4.4.4. Threats

Threats of the cabotage policy may be summarized as follows:

a) There is the fear that foreign investors may want to pull out of the vicinity in favour of fair competitive trade policy nations. Fair competitive trade policy argues that trade must be on equal basis between indigenes and non-indigenes.

b) The freedom of agencies such as oil companies to award contracts like time-charter contracts will be highly delimited by the policy, since such contract types can be awarded only to individuals or corporate agencies which qualify.

5. Conclusions

A good study of the historical aspects of the cabotage policy and the evolution of benefit maximizing principles associated with the policy has been performed in this work. While only very few nations have refused the practice of cabotage in favour of policies that allow competitiveness in shipping, a good number of nations in the world have embraced the practice of cabotage. Some have even practiced it for many decades if not centuries to date.

The rising problem presented by the cabotage policy is simply how to maximize benefits from the policy. Suggested strategies as contained in this work is hinged on global co-operation between ships of the cabotage size, owned by companies in the developed maritime nations and shipping companies operating in the cabotage waters of a country operating the cabotage policy.

The new regulation being discussed by the Indian parliament which claims, it wants to introduce competitiveness to the cabotage regime is merely an extension of the cabotage rule from the usual country level to the regional level. Such a policy if captured by many more nations will improve on the benefit maximization principle realizable from cabotage waters.

There is no doubting of the fact that the cabotage policy as adopted by many developing nations is undergoing a variety of changes. While the Australian version of the cabotage is increasing foreign participation through the award of more (SVP’s) single voyage permits and (CVP’s) continuous voyage permits, that of India intends to operate in the sub-regional basis. Foreign participation thus, is a rule which although not directly expressed by some nations, is seen as a fundamental requirement to the survival of the cabotage rule..

The Nigerian cabotage policy recognizes this by creating options for the Minister of transport to involve foreign ships in the cabotage trade provided they operate a defined joint venture relationship with Nigerian ship owners.

References

Hodgson, R.; Brooks, M.R (2004) – Canada’s Maritime Cabotage Policy. 82p., Dalhousie University, Halifax, Canada. Available on-line at http://maryrbrooks.ca/wp-content/uploads/2012/03/CabotageFinal.pdf

Kendall, L.C. (1986) - The business of shipping. 514p., Springer Netherlands, Houten, the Netherlands. ISBN: 978-9401083263. DOI: 10.1007/978-94-009-4117-5 [ Links ]

Onyemechi, C. (2013) - OSV Orderbook from Africa, What to Ex-pect? Offshore Support Vessel Africa, Accra Ghana,19-20 June 2013IBC Asia an Informa group [ Links ]

Pillai.A.; Paul, J. (2011) - Effect of Cabotage Policy on Coastal Shipping. AMET Journal of Management (ISSN: 2231-6779), 2(1): 9p., AMET University, Chennai, Tamil Nadu. India. Available on-line at http://www.ametjournal.com/attachment/journal2/EFFECT OF CABOTAGE POLICY ON COASTAL SHIPPING.pdf [ Links ]

Rose, R.S.K, (2011) - Future Characteristics of Offshore Support Vessels. 104p., Ms thesis, Massachussets Institute of Technology, Cambridge, MA, U.S.A. Available on-line at http://dspace.mit.edu/handle/1721.1/64580 [ Links ]

U.S. Congress (1989) - Competition in Coastal Seas: An Evaluation of Foreign Maritime Activities in the 200-Mile EEZ. 34p., Background Paper OTA-BP-O-55, U.S. Congress, Office of Technology Assessment, Washington, DC, U.S.A. Available on-line at https://www.princeton.edu/~ota/disk1/1989/8908/8908.PDF [ Links ]

Webb, Richard (2004) - Coastal shipping: an overview. 39p., Information and Research Services, Department of the Parliamentary Library, Canberra, Australia. [ Links ]

Zadoo, V. (2005) - Economy and Policy Business Standard March 21, 2005. [ Links ]

*Submission: 29 SEP 2014; Peer review: 14 NOV 2014; Revised: 17 DEC 2014; Accepted: 23 DEC 2014; Available on-line: 29 DEC 2014