Serviços Personalizados

Journal

Artigo

Indicadores

-

Citado por SciELO

Citado por SciELO -

Acessos

Acessos

Links relacionados

-

Similares em

SciELO

Similares em

SciELO

Compartilhar

e-Journal of Portuguese History

versão On-line ISSN 1645-6432

e-JPH vol.12 no.1 Porto 2014

ARTICLES

The Rise of a Tax State: Portugal, 1371-1401

António Castro Henriques1

1 Faculty of Economics - University of Porto. 4200-464, Porto, Portugal. E-Mail: antonio@castrohenriques.com

ABSTRACT

This paper uses the case of fourteenth-century Portugal to question a common assumption of fiscal history literature, namely the linear relationship between war-related fiscal demands increase the level of taxation. It is shown that this relationship is not straightforward and that not all wars decisively affect fiscal systems. In fact, as some contemporaries suggested, the effects of war on state revenues are essentially negative. As such, the rise of a tax state does not necessarily imply higher revenues. These two general contributions are grounded in a revision of the fiscal bargaining that took place between sovereign and subjects and in a revision of the existing quantitative evidence for the period 1367-1401. The paper makes use of unpublished data and also offers a critical review of the adoption of sales taxes (sisas) as a form of permanent taxation.

Keywords: Fiscal history, Ratchet effect, constitutional history, fiscal burden, taxation

RESUMO

Este artigo utiliza o caso de Portugal nos finais do século XIV para questionar um tema muito importante da literatura sobre história fiscal: a existência de uma relação linear entre as exigências financeiras das guerras e as chamadas revoluções fiscais. O caso português confirma que esta relação não é linear e que só em determinadas condições é que as exigências materiais das guerras têm um impacto decisivo no sistema fiscal. Na verdade, como sugerido pelos autores coevos, os efeitos da guerra na receita estatal são essencialmente negativos. Como tal, a afirmação de um estado contributivo (tax state) não implica necessariamente uma receita superior, ao contrário do que sugere a literatura. Estes dois contributos gerais encontram-se fundamentados através da reinterpretação da negociação fiscal entre súbditos e soberanos ao longo do século XIV, tanto a nível das Cortes como a nível municipal, e através de uma análise dos dados quantitativos sobre a receita do estado português entre 1367 e 1401. Estas duas análises integram dados inéditos e uma revisão crítica do processo de adopção das sisas como imposto régio permanente.

Palavras-chave: História fiscal, Sisas, história constitucional, carga fiscal

Introduction

Wars came and a new world was born, a world very different to the one before. Thus reads the prologue to the chronicle of King Fernando written by Fernão Lopes. Throughout his works, Lopes often ascribed to the Fernandine Wars (1369-71; 1372-3; 1381-2) and the ensuing War of Independence (1383-1411) the profound changes undergone by Portuguese state finances: the squandering of the royal treasure, the feeble war coinages, the unprecedented tax burdens, or even the stringency of the court of João I (CF: Prologue, Chapters XLIX, LIV; CJ: Chapter CCI).

Twentieth-century Portuguese historiography followed F. Lopes and acknowledged that the later fourteenth-century wars meant a radical change for Portuguese state finances. Gama Barros and A.H. Oliveira Marques emphasized that the intense depreciation of coinage under Fernando I ( regnavit 1369-83) and João I (regnavit 1385-1433) was intended to fund military campaigns (Barros, 1945-54: III, p. 147, Marques, 1987: pp. 201-10). Iria Gonçalves claimed that previously rare kingdom-wide taxes were frequently levied in this period (Gonçalves, 1964). This increase in extraordinary taxation led, in turn, to a more frequent meeting of the Cortes for fiscal purposes, as shown by Armindo de Sousa (Sousa, 1990). Most importantly, these late fourteenth-century wars have been highlighted by historiography as the direct cause for the adoption of public taxation in the shape of sales taxes or sisa (plural: sisas). Some historians even claimed that it was sales taxes that led to the creation of important institutions like the almoxarifado (Marques, 1986: p. 300, Godinho, 1999) and the vedor da fazenda (Homem, 1990: p. 129), although these institutions dated from earlier times (Henriques, 2008: p. 138-51, 313).

These ideas echo the conclusions drawn by the self-styled fiscal history works (Bonney, 1999, Bonney and Ormrod, 1999, Bonney, 1995). In the words of Bonney, major wars constitute the primum mobile that leads to major changes in the level of revenues and in the structural features of state finance (Bonney, 1995: 13). This view was later developed in an important essay by Bonney and Ormrod (1999), which related the evolution of state finances to revolutions that toppled existing fiscal systems and replaced them with new ones. These revolutions were essentially triggered by wars and implied not only a lasting increase in the level of revenues and expenditures but also profound changes in the whole institutional and political framework. In the wake of Schumpeters Domänenstaat/Steuerstaat dichotomy, Bonney and Ormrod identified different types of fiscal systems: tribute state, domain state, tax state and fiscal state. A fiscal revolution meant a transition between any of these types.

This linear relationship between the demands of war and fiscal revolutions requires major qualification in order to fit the existing cases. Importantly, many well-informed contemporaries thought otherwise. Fernão Lopes, as mentioned, considered that wars impoverished rulers because they impoverished subjects (CF: Prologue). Ibn Khaldun (1336-1408) theorized that the burdens brought by wars led to excessive taxation and a decrease of trade and production (Alferai and Brun, 1994). In his political testament of 1419, Dodge Mócenigo used an impressive array of figures to warn that the real revenues of states and their citizens fall dramatically after wars (Visentini, 1903: doc. 82). These observers cannot be lightly discarded. Moreover, not all wars, however protracted and expensive they may be, cause such decisive, no-turning-back revolutions. Fifteenth-century England provides a case in point. The fiscal demands related with the Hundred Years War did not give rise to a permanent tax comparable to the French gabelleor the Castillian alcabala. Instead, by the end of this secular conflict, England reverted to the status of a domain state. Wars might well be a necessary cause for a fiscal revolution, but they certainly are not a sufficient cause.

The present state of research requires in-depth case studies in order to clarify the forces that lead to changes in fiscal systems. The present work assesses the impact of war on late fourteenth-century Portuguese state finances in order to test the thesis of warfare-led fiscal revolution. This requires that we revise the existing scholarship on taxation justified by military efforts, namely the sisa tax, and its empirical foundations (Part I). Part II deals with the constitutional aspects of taxation. Part III attempts to quantify and assess the impact of the new taxation on state finances at the local level. Finally, Part IV does the same thing at aggregate level. All these sections make use of both published and unpublished sources. The conclusion summarizes the contribution of the present case study.

I

Schumpeters original Domänenstaat/Steuerstaat dichotomy is built from a constitutional standpoint. The former was sustained by the means that the prince could freely dispose of, whilst the latter implied resources with a public rationale (Musgrave, 1992: pp. 90-3). The participants at mid-fifteenth-century Cortes would have little trouble in understanding the gist of Schumpeters theory. From their words, it is clear that royal revenues were twofold, consisting of direitos reais and sisas. This distinction was as much a historical as a constitutional onewhile the former encompassed ancient proceeds collected since the time of the old kings, the latter had been granted by the Cortes to the crown during the defensive war against Castile. 2

The representatives of the municipalities, or Povos, regarded the sisa tax as a conditional, temporary service to the king. Instead of a voluntary, and hence precarious, grant to the monarchy, the sisa had become a proper tax, in the sense that it was imposed permanently in order to protect a public objective. As the Povos would repeatedly remind the monarchs well into the sixteenth century, this tax was not to be mistaken for a direito real (Dias, 2003: p. 98).

As the municipal representatives explained in a grievance presented in the Cortes of 1439, the direitos reais were intrinsic to the crown (comfiscaaes com a Coroa) and worked as a permanent endowment for the upholding of the royal estado. 3 Many different taxes and proceeds fell under this guise. It included tributes paid by the religious minorities (Jews and Muslims), tolls, customs, land rents, court fees, judicial fines, old levies that had lost their rationale centuries before (sãojoaneira, fossadeira, jugada, moeda foreira), revenues from the kings churches and monopoly rents. While seemingly disparate and archaic, these revenues were bundled together, first at a municipal and then at a regional level. They were administered through a network of almoxarifadosfrom the 1260s onwards (Henriques, 2008: pp. 112-46).

Parliamentary discourse was, of course, one-sided. In his chronicle of João I, Fernão Lopes, who worked as a secretary of Prince Duarte, provided an educated response to the claims of the contemporary municipal representatives: some reckon and avow nowadays that the kings made up this yoke and set it upon the people; yet, because things did not go this way, we want to dispel this opinion: ( ) since the time of Afonso IV ( ) the Povos already held sisas among them in their towns ( ). Seeing the income of these sisas, the kings yearned for them and evoked past or future necessities to ask for these taxes graciously for no more than two or three years. 4

Historians, namely Gama Barros (1944-54), Iria Gonçalves (1964) and Jorge Faro (1965), built upon the interpretation of Fernão Lopes and regarded sisas first and foremost as a municipal tax alienated by the monarchs. Faro pointed out that the use ofsisas responded to the problems created by the older municipal levies based upon income and property (talha and finta). The yield of these levies was limited by collective exemptions, namely the church and the nobility, which meant that much of the existing land and/or wealth remained untaxed. According to the same author, the sisa tax also made it possible to assemble the required sum relatively fast, in contrast with the lengthy procedures arising from taxes on income or wealth (Faro, 1965: p. lxxxi). These historians also regarded sisas as striking an optimal balance between efficiency and equity. It seemed that fourteenth-century Portuguese municipalities had found a tax that was as acceptable as it was productive, whilst royal finances remained tied to the patrimonial direitos reais. Thus, Fernando I and João I used the pretext of war to wrestle the sisas from the municipalities, eventually making them the mainstay of royal finances. This was, after all, a seductive narrative that presented state-building as a bottom-up construct and fits well the concept of centralização, the notion that a limited, medieval state progressively morphed into a centralized, modern one.

This narrative, which ultimately derives from Fernão Lopes, requires a critical revision. First of all, the earliest known occurrence of a sisa is not to be found among the municipalities but among the Jewry. In 1316, this community used sales taxes (sisa) as a means of apportioning their yearly serviço to Dinis I in 1316. 5 The first evidence of a sisa collected within a municipality dates from 1336. However, the sisas collected in that year were not used to pay for municipal expenses. Likely preparing his attack on Castile (Martins, 2005: pp. 25-9), Afonso IV requested from Lisbon and Porto that their customary service to the king should take the form of a sisa on wine, as we are informed by royal letters kept in both municipal archives (AMP, Livro 1 de Pergaminhos, n. 18; Câmara Municipal de Lisboa, 1949: doc. 3).

In the letter sent to the municipality of Lisbon in 1336, Afonso IV commanded the municipal officers of Lisbon to summon the assembly in order to authorize (outorgar) the application of the sisa. In this instance at least, sisas were not municipal taxes, but the means chosen to collect a subsidy required by the crown. The 1336 sisa is the first in a long list of sisas collected within the municipality by municipal officers, but ending up in the kings coffers. In fact, nearly all of the sisas documented in the fourteenth century were demanded by the king (Henriques, 2008: p. 152). Instances of sisas levied by the municipalities to pay for their own expenses were first documented in Lisbon only in 1355 (Câmara Municipal de Lisboa, 1949: docs. 5 and 6). In spite of Lopes emphatic claim that the monarchy diverted the sisas for its own purposes, it is also possible to document the opposite situation: the municipality of Porto collected sales taxes in 1367 in order to pay a service to the king, but the proceeds from the tax were diverted to repair the city walls with royal authorization (AMP, Livro A, fol. 149).

The key question is not whether it was the monarchy, the Jewry or the municipality who created the sisas. Quite probably, all these entities were aware of the fiscal solutions used by Aragonese and Castilian cities (Duarte, 2000). Given the scarce documentary basis, this remains an open problem. What is clear is that the sisa could hardly have existed without the collaboration, if not the initiative, of the crown. In fact, municipalities could not bind privileged groupsnobles, clergymen, tenants of the kings lands (reguengueiros)to pay for the tax without borrowing royal authority. In the 1336 letter to Lisbon, the monarch explicitly indicated that he would allow the wine sold by his reguengueiros to be taxed. Jorge Faro identified another telling case: faced with the fiscal evasion of the clergy and their dependants, the Algarve towns witnessed a serious fall in the revenue received from the sisas they imposed to pay for the construction of watchtowers. Thus, their representatives required King Afonso IV to compel the clergy to pay these taxes along with the others (Faro, 1965: p. lxxxix).

The fact that the sisas demanded (or at least sanctioned) by the crown overrode privilege made them more expedient for municipalities and crown alike. The efficiency of indirect taxation required universal liability; otherwise, the privileged would channel the taxed merchandise. Thus, equity and efficiency were interrelated, as Gonçalves and Faro suggested.

While the notion of an autonomous development of the sisa by the local governments clashes with the existing sources, municipal interests and values played an important part in the development of the sisa. As hinted at by Fernão Lopes and confirmed here, the adoption of sales taxes resulted largely from a deliberate choice of taxpayers at the municipal level. The sisa provided an opportunity to extend the tax base to those who dodged older levies on income and land (the finta and the talha). These very arguments were used in the case of Porto to justify the option for the use of sisas instead of the taxes on land income (talhas) from which some would be exempt (AMP, Livro A, fol. 149). In 1336, the Lisbon municipal officers and assembly unanimously preferred the sisa on wine to its alternative, thetalha (Câmara Municipal de Lisboa, 1949: doc. 3). According to a letter sent by the municipality of Porto to the king in 1368, the sisa on wine also avoided the endless disputes brought by the application of thetalha (Faro, 1965: pp. lxxviii-lxxx). At Porto, the 1368 sisa was thus regarded as a common and beneficial good for all, as both great and small paid communally according to what they spent (Ferreira, 1980: pp. 364-66).

All in all, it is not enough to understand the development of the sisa tax as a zero-sum game, as Fernão Lopes or the fifteenth-century Cortes did. During the fourteenth century, sisas represented an instance in which two institutions negotiated in order to further their own interests. The monarchy obtained the necessary sums, while the municipality temporarily borrowed the wider, universal authority of the kings. Also, as argued by M. Farelo, it is important not to exaggerate the antagonism between two institutions that were served by the same social groups. Tax-farmers, municipal elites and holders of state offices largely coincided (Farelo, 2008: Chapter 3).

The existing interests had found an equilibrium that would be seriously disrupted by the Fernandine Wars. After an unsuccessful attempt to seize the throne of Castile, funded with the treasure amassed by his ancestors and by debasements, King Fernando sought new ways of financing his second (1372-73) and third (1381-82) war against Castile.

II

In 1372, in the context of the Second Fernandine War, the monarchy imposed sisas in all the lands of the kingdom (Marques, 1990b: p. 141). This imposition was deemed a scandal for two reasons. Firstly, the municipal representatives were consulted neither in parliament nor individually. Secondly, this sisa was to be collected ad valorem. This was a decisive break with the past. It is highly telling that the first ad valorem sales tax dates from a period when the monetary manipulations of Fernando I were at their liveliest (Marques, 1978). Collecting an ad valorem sales tax would leave the value of the revenue unscathed by the price rises caused by debasement.

Whilst clearly beneficial to the monarchy, the change to an ad valorem rate was deeply resented by the municipalities, who argued that it led to a dearth in the taxed products (AML, Livro I de Serviços a El Rei, doc. 4). At the Cortes of Évora held in 1374, the Povos complained to Fernando I that sisas were causing a standstill in trade across the border (Marques 1990b: p. 141). The municipality of Lisbon also claimed that ad valorem taxes had caused a scandal among the people (AML, Livro I de Serviços a El Rei, n. 4). For this reason, some border municipalities (Bragança, Mós and Torre de Moncorvo) obtained a reduction in the rate of the sisa that was applied (Cunha and Costa, 2004: docs. 43 and 44; Marques, 1990b: pp. 142-43). Other municipalities were allowed to find an alternative to the sisas. 6

The hostility against ad valorem sales taxes lingered. One of the first demands of the Cortes that elected João I as king (Coimbra/1385) was the cancellation of all the sisas that were then being collected and their replacement with a direct tax yielding the same amount (Barros, 1944-54: vol. IX, p. 419). Newly acclaimed João I could not refuse. However, two years later, João I demanded a temporary grant of the sisa tax, again in its much-maligned ad valorem form. With the Castilian threat still looming, thePovos did not refuse either (AML, Livro I de Cortes, doc. 7, fol. 63; AMP, Livro A, fol. 177v-180). The defensive context changed everything. These new sisas had a high ad valorem rate of 10 per cent, equal to the contemporary Castilian alcabala (Menjot, s.d.), but three times higher than the scandalous 3.2 per cent demanded by Fernando I in 1371. Nevertheless, its defensive rationale made it acceptable to the Povos.

III

The historians acknowledgment of the importance of sisas has not been matched by any noticeable effort in quantifying their impact on state finances. As is the case with fiscal history studies, it is assumed that tax states have higher revenues. The purpose of this section is to fill this gap by comparing the value of the sisas with that of the direitos reais.

Contrary to what Lopes and the Povos suggested, the sisas of the 1330s were very different from those introduced during the Fernandine Wars, which remained in place until 1538. Until the reign of Fernando I, sisas were levied on the transport of merchandise to the municipal boundaries. The sisas collected in 1336 (both in Porto and Lisbon) and in Lisbon in 1355 taxed all wine entering the municipality, where it would have been consumed, sold or exported. As such, these levies were closer to tolls than to proper sales taxes.

Tolls were hardly new. Twelfth- and thirteenth-century municipal charters set tolls (portatica/portagens) on a considerable range of commodities crossing over municipal boundaries and detailed the ad ponderum rates that these were liable to. A few of these charters also included proper sales taxes, the alcavalas. The preexistence of tolls and other dues affecting trade and consumption makes the triumph of the sisas intriguing. It is not possible to claim that this new contribution expanded the tax base to include hitherto untapped wealth. So why were sisas more rewarding than tolls or alcavalas? One first reason is that tolls and sales taxes were collected according to ad ponderum rates rigidly set in twelfth-century charters, as in the case of Lisbon. After two centuries of price increases, these rates tapped an increasingly small share in the value of the trade. Secondly, the liquidity of tolls was also affected by the custom of vizinhança, by virtue of which locals became exempt only by paying a small annual fee (Farelo, 2008: pp. 212-3). Finally, kings often exempted individuals and entire municipalities from the payment of tolls.

Thus, the sisas had two advantages over the existing levies: they admitted no exceptions and they were collected according to new, realistic rates. This implied that sisas taxed sources of wealth that had previously evaded municipal and royal taxation. In 1336, the sisa levied on wine in Lisbon brought in 25,000 libras per annum (Câmara Municipal de Lisboa, 1949: doc. 3), whilst tolls on all goods in the same year only amounted to 15,000 libras in a tax-farming contract (Marques, 1990a: II, pp. 80-3).According to Fernão Lopes, the sisa on wine collected at the port of Setúbal in the reign of Afonso IV, but before the Plague (1325-47), yielded 4,000 libras, whilst its tolls only brought in 1,100 libras in 1336. These examples show that sisas taxed wealth that escaped the old tolls.

We can argue that this new form of taxation drew revenue from wealth that had evaded earlier taxes. This difference can be observed by comparing a handful of cases, for there was both the tax-farming contract for the payment of sisa and the total amount of the direitos reais at a disaggregated level.

Table 1 confirms that the contribution of the sisas was in fact important but, contrary to what has been assumed by most historians, it did not immediately obliterate the direitos reais. The sisa / direitos reais ratio was only greater than 2 in Lamas de Orelhão and Vila Viçosa, two municipalities whose direitos reais had been devolved to local governments in exchange for an annual payment in 1259 and 1297. This was not the general rule, however, as there were no more than 38 municipalities in this situation, of which only Guarda, Trancoso, Vila Real and Viana appear to have been of any considerable size (Reis, 2007: p. 116). By contrast, in the case of the comarca of the Algarve, which included customs duties, it appears that direitos reais still remained the mainstay of royal finances. This is also confirmed by the municipality of Arronches. The trajectory of the revenues collected in Sintra between 1297 and 1370 is also indicative of the fact that the direitos reais were able to withstand inflation.

Table 1 – Direitos Reais (at the local level) and Sisas collected in 1382 (in libras)

| Territory | Direitos Reais | Sisas In 1382 | Sisa / Direitos Reais |

| Algarve | 27000 (value of the farm in 1383) | 13000 | 0.48 |

| Arronches | 1500 (revenue in 1371) | 1000 | 0.66 |

| Lamas de Orelhão | 200 (fixed rent agreed in 1259) | 1250 | 6.25 |

| Portalegre | 1200 (revenue in 1297) | 2000 | 1.66 |

| Sintra | 3400 (revenue in 1297) 4200 (revenue in 1370) | 4400 | 1.29 1.05 |

| Vila Viçosa | 1000 (fixed rent agreed in 1297) | 2167 | 2.16 |

Source: for 1382 sisas, TT, CHR, Fernando I, Lv. 3, fols. 18v (Lamas de Orelhão), 20 (Arronches), 37 (Vila Viçosa), 54 (Portalegre), 86-86v (Sintra); for municipal rents, TT, CHR, Fernando I, Lv. 3, fol. 20 (Arronches, 1371), TT, CHR. Afonso III, Lv. 1, fol. 195 (Lamas de Orelhão, 1259), (Sá-Nogueira, 2003: doc. 68), doc. 68 (Portalegre and Sintra, 1297); TT, CHR, Dinis, Lv. 3, fol. 1v (Vila Viçosa, 1297), ASV, Collectoriae 179, fol. 22v (for SIntra 1370), Marques, 1988: vol. III, p. 420 (for the Algarve, 1383).

The tax-farming contracts of the 1382-84 sisas agreed in the winter of 1381 make it possible to estimate the total revenue (Table 2). Although none of the tax-farm contracts contained the rates of the sisa geral, a later contract drawn up in accordance with these sisas shows that they were collected ad ponderum (TT, Gavetas, Gaveta 12, m. 1, doc. 13).

Table 2 – Tax-Farms of the sisas for 1382, by comarca

| Comarca | Value (in thousands of libras) | Notes |

| Lisbon | 105 | |

| Entre Tejo e Odiana | 96 | Estimated value (obtained by multiplying the average of the 11 tax farms known for this comarca by the 45 municipalities existing in this comarca). |

| Estremadura | 79 | Estimated value (obtained by multiplying the average of the 16 tax farms known for this comarca by the 38 municipalities existing in this comarca). |

| Beira | 40 | |

| Entre Douro e Minho | 25 | Estimated value, assuming that the total value of the tax farm was 400,000 libras. |

| Porto | 22 | |

| Trás-os-Montes | 20 | |

| Algarve | 13 | |

| TOTAL | 400 |

Note: Lisbon and Porto were not comarcas; they are shown here separately from Estremadura and Entre Douro e Minho because of their importance.

Source: TT, CHR. Fernando I, Lv. 3, fols. 3-96.

Given that the Cortes of 1385 proposed to João I a subsidy of 400,000 libras to make up for the sisas, there is little doubt that the 1382-84 sisas were expected to yield that sum per annum. Considering the average yearly ordinary revenue of 960,000libras under Pedro I (1357-67), indicated by Fernão Lopes, the sisas represented an increase of 41%. By 1382, the proportion would be even higher, on account of at least three factors: a) the effects of war on production and trade; b) the assignment of sources of revenue to noble captains; c) debasements, which affected land rents and debt arrears. Thus, the temporary ad ponderum sales taxes of 1382 implied an increase of about 40% in overall revenue.

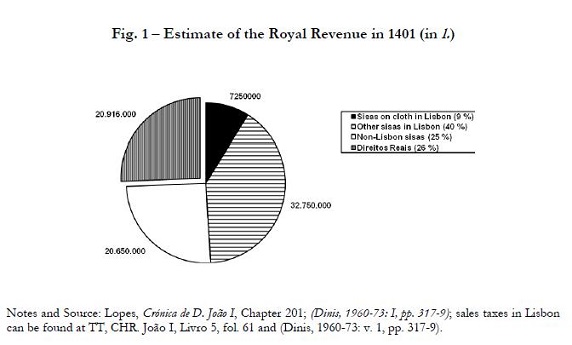

As has been seen, war and the corresponding collection of the sisas did not mean an immediate transition to a tax state. No quantitative data whatsoever exist for the years of intense warfare between 1383 and 1400. Nonetheless, the ten-year truce agreed between Portugal and Castile in 1401 was an opportunity for João I to estimate his ordinary revenues in order to set his expenditure. A combination of three different sources, including data used by Fernão Lopes, allows for a rough breakdown of the revenues of the Portuguese crown in 1401, as shown in Fig. 1.

In 1401, after three decades of war, the nominal revenue of the monarchy had rocketed: it was roughly 80 times higher than in 1367. However, this reflects mainly the debasement of the Portuguese coinage. What appears more remarkable is the change in the structure of tax receipts. By 1401, the sisa had become the mainstay of royal finances, accounting for 74 per cent of revenue, whereas the temporary sisa in 1382 represented only 28 per cent of revenue.

This transition to the tax state should be largely ascribed to debasement. Whilst debasement and price rises threatened land rents and taxation based upon ad ponderum rates, they did not harm the value of sisas. As these were ad valorem, they were pegged to inflation. Whilst price increases led to a growth in tax revenue, they also led to a decrease in Direitos Reais. Traditional revenues – tolls, customs, land rents – had their values and ad ponderum rates denominated mostly in libras. 7

IV

The permanent adoption of sisas led to a radical change in state finances as these taxes eventually became the major form of contribution in the domain. This predominance would continue throughout the fifteenth century. 8 However, it is unclear whether this change in the composition of tax receipts did in fact lead to an effective increase in the crowns revenue. As mentioned earlier, Fernão Lopes and his contemporaries regarded wars as a destructive influence on royal revenues. This is especially likely in the present case, where minting profits and debased currency were essential for ensuring the victory over Castile. Were Lopes and his contemporaries right?

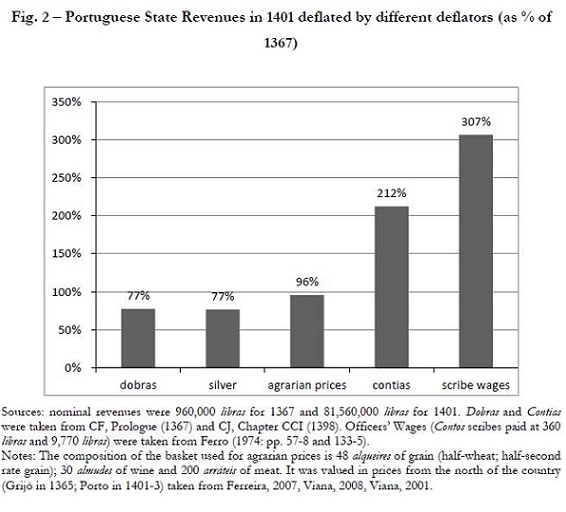

Available sources allow us to compare the revenues for two benchmark years, 1367 and 1401, conveniently placed before and after the period of intense military activity. The choice for a term of comparison is more problematic, however. Nominal values are meaningless for this comparison, given the serial debasements that started in 1385. The metallic content of the nominal currency, an alternative measurement commonly used by the literature, is less misleading. Additionally, we can also imitate fifteenth-century chroniclers, who used past exchange rates with stable gold coins when attempting to make diachronic comparisons of nominal values. The exchange rate of the dobra in libras provided by Lopes allows for this.

Yet, these two methods are insufficient, given that the stock of precious metals probably suffered major changes in these 34 unstable years, moreover given that the silver famine was particularly acute in Portugal (Ferro, 1974: pp. 21-5). Metallic content and exchange rate conversions are no substitute for real values, which measure the purchasing power of nominal sums. Real values also have the advantage of proxying crown revenues as a percentage of output. Assuming that these three decades saw no trend growth in per capita output or in population and that the shares of the sectors did not change dramatically, the prices of a realistic individual consumption basket are a good proxy for total output. Thus, real values not only provide an apt deflator, but they also serve as a proxy for the variation in the share of the countrys output paid as taxes.

Although both purchasing power and metallic content are useful terms of comparison, it should be noticed that price inflation was not a direct threat to the Portuguese crown, which relied on its own lands for consumption and sale. The increasing price of services, mostly military in nature, was far more threatening. There is no information available on military wage rates for these two dates. However, two other meaningful items have been included here: the yearly subsidy paid to the nobles in order to maintain their fighting equipment and horse, the contia, and the wages of the scribe of the Contos, a particularly well-documented office. The results of these five different deflators are shown in Fig. 2.

Were the old kings wealthier than João I, as implied by Fernão Lopes? The answer is not straightforward as, tellingly, different deflators indicate different trajectories. Looking at the situation from the perspectives of metallic content and exchange rates, it appears that Lopes was right. Despite its impressive contribution, the sisa could not halt the decay of the intrinsic content of the revenues. This did not, however, mean that the old kings used to have a considerably larger command over agrarian goods. When total revenues are deflated in real terms, the two periods appear remarkably similar (revenues in 1401 were 96% of those of 1367). Likely, the share of total output was broadly similar in the two periods. As the sisas were applied according to ad valoremtaxes the crowns real revenue remained the same in spite of the price increases. Seen from this angle, the transition from domain to taxation revenues did not translate into a higher capacity to capture the value in the economy.

The key difference lies in the fact that João I could secure specialized services in far greater quantity than his predecessors before the war. Benefiting from ad valorem sales taxes, the state was not harmed by rising prices. By 1400, in contrast, the state turned price changes to its favor by postponing the adjustment between inflation and wages: with broadly the same revenue, the crown could pay for three times as many officers as in 1367 and could disburse twice the amount of contias (which were the sole source of income for many a poor knight). While, for most subjects, price increases could well be a life-or-death matter, for a monarchy with lands of its own, some coercive power over labor and a fiscal system based on ad valorem sales taxes, debasement-fuelled dearth did not constitute a major problem.

Conclusion

War was certainly a decisive factor in Portugals emergence as a tax state. By 1400, after the long confrontation with Castile, sales taxes represented three quarters of receipts, with the traditional sources of revenue accounting for the remaining 25%. However, it was the defensive war against the Castilian invasion, rather then the expansionist conflict than the expansionist conflicts triggered by Fernando I, that led to this result. Whilst Fernando I had to settle for temporary, low-rate taxation, João I obtained permanent high taxes (ad valorem sales taxes at 10%). In fact, the defense of the realm provided the only constitutional setting that allowed the monarchy to obtain a firm grip on the sisas. English kings claiming the French throne did not enjoy the same support and, as such, many royal attempts to expand the fiscal burden were thwarted (Ormrod, 1994; Ormrod, 1999: p. 184). Likewise, the French gabelle and the Castilian alcabalas were born of the constitutionally legitimate aims: defense of the realm against the English and the Reconquest, respectively. It appears that just wars are more likely to bring about fiscal revolutions.

The second contribution of the present case study lies in the study of the real revenues. The revenues of the Portuguese taxe state were similar to those of the domain state. The ratchet effect was absent because, as authors like Fernão Lopes well knew, the destruction and the debasement wrought by wars diminished the domain revenues. As such, successful tax states had to adjust their fiscal system to the military context. In Portugal, the solution took the form of heavy sales taxes which, being ad valorem, hedged the value of royal revenues against the effects of a conflict essentially subsidized by debasement. The rise of the Portuguese tax state did not imply a real increase in the fiscal burden. It was a response to the destructive effects of war on the domanial revenues.

ABBREVIATIONS

AML - Arquivo Municipal de Lisboa

AMP - Arquivo Municipal do Porto

ASV - Archivio Segreto Vaticano

CF – Crónica de D. Fernando I.

CHR – Chancelarias Régias

CJ – Crónica de D. João I

TT – Torre do Tombo

REFERENCES

ALFERAI, A. and BRUN, M. 1994. Ibn Khaldun: Dynastic change and its economic consequences. Arab Studies Quarterly, 16, 73-87. [ Links ]

BARROS, H.D.G. 1945-54. História da Administração Pública em Portugal, Lisbon. [ Links ]

BONNEY, R. (ed.) 1995. Economic Systems and State Finance, Oxford. [ Links ]

BONNEY, R. (ed.) 1999. The Rise of the Fiscal State in Europe, c.1200-1815, Oxford. [ Links ]

BONNEY, R. and ORMROD, W.M. (eds.) 1999. Crisis, revolutions and self-sustained growth: Towards a conceptual model of change in Fiscal History, Stamford: Shaun Tyas. [ Links ]

CÂMARA MUNICIPAL DE LISBOA (ed.) 1949. Livro I de Místicos. Livro II del-rei Dom Fernando, Lisbon: CML. [ Links ]

CUNHA, C. and COSTA, P.P. (eds.) 2004. Trás-os-Montes Medieval e Moderno. Transcrição de Fontes Documentais, Bragança: Arquivo Distrital de Bragança. [ Links ]

DIAS, J.J.A. (ed.) 2003. Cortes Portuguesas. Reinado de D. Manuel I (Cortes de 1498), Lisbon: CEH. [ Links ]

DINIS, A.J.D. (ed.) 1960-73. Monumenta Henricina, Coimbra: Comissão Executiva para a comemoração dos 500 anos da morte do infante D. Henrique. [ Links ]

DUARTE, L.M. 2000. A Fiscalidade Municipal Portuguesa. Estado da Questão. Congrés d'Historia de la Corona d'Aragó. Barcelona: Universitat de Barcelona. [ Links ]

FARELO, M.S.D.S. 2008. A Oligarquia Camarária de Lisboa (1325-1433). PhD dissertation, Universidade de Lisboa. [ Links ]

FARO, J. (ed.) 1965. Receitas e Despesas da Fazenda Real de 1384 a 1481. Subsídios Documentais, Lisbon: Centro de Estudos Económicos. [ Links ]

FERREIRA, J.A.P. (ed.) 1980. Vereaçoens. Anos de 1401-1449, Porto: Gabinete de Estudos de História do Porto. [ Links ]

FERREIRA, S.C. 2007. Preços e Salários em Portugal na Baixa Idade Média. Mestrado, Universidade do Porto. [ Links ]

FERRO, M.J.P. 1974. Estudos de História Monetária Portuguesa, Lisbon, s.n. [ Links ]

GODINHO, V.M. 1999. Finanças Públicas e Estrutura do Estado. Dicionário de História de Portugal, 2nd ed. Porto. [ Links ]

GONÇALVES, I. 1964. Pedidos e Empréstimos Públicos em Portugal durante a Idade Média, Lisbon, Cadernos de Ciência e Técnica Fiscal. [ Links ]

HENRIQUES, A.C. 2008. State Finance, War and Redistribution in Portugal. 1249-1527. PhD, University of York. [ Links ]

HOMEM, A.L.D.C. 1990. O Desembargo Régio (1320-1433), Porto, Junta Nacional de Investigação Científica. [ Links ]

MARQUES, A.H.D.O. 1986. Portugal na Crise dos Séculos XV e XVI, Lisbon, Presença. [ Links ]

MARQUES, A.H.D.O. (ed.) 1990a. Chancelarias portuguesas: D. Afonso IV: Lisbon. [ Links ]

MARQUES, A.H.D.O. (ed.) 1990b. Cortes Portuguesas. Reinado de D. Fernando I, Lisbon: INIC. [ Links ]

MARQUES, J.D.S. (ed.) 1988. Descobrimentos Portugueses. Documentos para o seu estudo, Lisbon: INIC. [ Links ]

MARQUES, M.G. 1978. Moedas de D. Fernando I, Lisbon, s.n. [ Links ]

MARTINS, M.G. 2005. A Guerra Esquiva. O Conflito Luso-Castelhano de 1336-38. Promontoria, 3. [ Links ]

MENJOT, D. s.d. Alcabalas. In MENJOT, D., SÁNCHEZ MARTÍNEZ, M. and VERDÉS PIJUAN, P. (eds.) Glosario Critico de Fiscalidad Medieval. Barcelona: CSIC. [ Links ]

MUSGRAVE, R.A. 1992. Schumpeter's crisis of the tax state: An essay in fiscal sociology. Journal of Evolutionary Economics, 2 , 89-113. [ Links ]

ORMROD, W.M. 1994. The domestic response to the Hundred Years War In CURRY, A. and HUGHES, M. (eds.) Arms, Armies and Fortifications in the Hundred Years War. Woodridge: Woodridge. [ Links ]

ORMROD, W.M. 1999. Finance and Trade under Richard II. In GOODMAN, A. and GILLESPIE, J.L. (eds.) Richard II. The Art of Kingship. Cambridge: Cambridge University Press. [ Links ]

REIS, A.M. 2007. História dos Municípios. 1050-1383, Lisbon, Horizonte. [ Links ]

SÁ-NOGUEIRA, B.D. (ed.) 2003. O Livro das Lezírias d'El-rei Dom Dinis, Lisbon: Centro de Estudos Históricos. [ Links ]

SOUSA, A.D. 1990. As Cortes Medievais Portuguesas (1385-1490) Porto, INIC. [ Links ]

VIANA, M. 2001. Alguns Preços de Vinho em Portugal (séculos XIV-XV). Arquipélago - História, 5 (2ª série). [ Links ]

VIANA, M. 2008. Alguns Preços de Cereais em Portugal (Séculos XIII-XVI) Arquipélago - História, 2ª série, XI - XII, 207-280. [ Links ]

VISENTINI, F. (ed.) 1903. Bilanci generali della repubblica di Venezia, Venice: Reale Commissione per la pubblicazione dei documenti finanziari della repubblica di Venezia. [ Links ]

Received for publication: 18 December 2013

Accepted in revised form: 17 February 2014

Recebido para publicação: 18 de Dezembro de 2013

Aceite após revisão: 17 de Fevereiro de 2014

NOTES

2 The contrast between sisas and direitos reais was formulated in 1439 and in 1459: TT, Suplemento de Cortes, maço 4, doc. 41; TT, Cortes, maço 2, n. 14.

3 See note 1.

4 E vendo os Reis taaes remdas de sissas, avemdo vontade de as aver, mostravã ao povo necesidades pasadas ou que eram por vir e pedimdolhas graciosamente por dous ou tres anos que logo as leixariom . Cron. João I, Chapter CCI.

5 TT, CHR, Dinis, Lv. 3, fol. 104: per razom da ssisa que antressi fezerom pera pagarem a mim os meus seruiços. The Jews were still using the sisa in 1328 (TT, Gavetas, Gaveta 12, m. 4, doc. 24).

6 The municipality of Lisbon vowed to compensate the king by collecting a two per cent tax on wealth in 1373. But it ended up returning to the sisa in the same year (AML, Livro de Serviços a El Rei, n. 5). After this, the municipality of Lisbon extracted from Fernando I the promise that the city would not pay sisasagain (AML, Livro I de Serviços a El Rei, n. 6).

7 In 1401, the all-important Lisbon customs and tolls were collected according to ad ponderum rates set in around 1377. The rights and jurisdictions from the bishop of Porto that João I captured were worth a paltry 300,000 libras in 1405 (TT, Gavetas, Gaveta 1, m. 1, n. 15)

8 Sisas represented less than 90 per cent of the revenues at the almoxarifado level. Compare TT, CHR. Afonso V, Lv. 27, fol. 164 (Beja, 1440) with TT, CHR, Manuel I, Lv. 17, fl. 41 (Beja in 1498).