Serviços Personalizados

Journal

Artigo

Indicadores

-

Citado por SciELO

Citado por SciELO -

Acessos

Acessos

Links relacionados

-

Similares em

SciELO

Similares em

SciELO

Compartilhar

Economia Global e Gestão

versão impressa ISSN 0873-7444

Economia Global e Gestão v.15 n.1 Lisboa abr. 2010

The Effect of Industry Life Cycles and Strategic Alliances on Employment Contract Modeling

Irem Demirkan* and Sebahattin Demirkan**

Assistant Professor of Strategy and International Business, College of Business and Administration, Northeastern University, Boston, Massachusetts, USA / Professora de Estratégia e Negócios Internacionais na Faculdade de Negócios e Administração, Universidade de Northeastern, Boston, Massachusetts, EUA.

Assistant Professor of Accounting and Finance, School of Management, SUNY Binghamton University, Binghamton, New York, USA / Professor de Contabilidade e Finanças na Escola de Administração, Universidade de Binghamton, Binghamton, Nova Iorque, EUA.

ABSTRACT

This paper analyses what kind of employment contract must be offered to the manager (agent) of a company by the owner (principal) in the case of strategic alliance formation by taking into consideration their industry life cycles. Agency problem may arise between managers and principals because managers actions may not be intrinsically unobservable in strategic alliances. A set of proposals and models is suggested mainly based on the various levels of uncertainty prevailing in the industry. Overall, the shows that in mature stages of the industry, principals are better off by offering the contract where agents receive a fixed payment (i.e. the first best solution), whereas in growth stages agents get fixed payments with additional performance pay (i.e. the second best solution). In both cases the principals get the residual outcome.

Keywords: Agency Theory, Strategic Alliances, Employment Contract Modeling, Industry Life Cycles

O efeito dos ciclos de vida na indústria e das alianças estratégicas na elaboração dos contratos de trabalho

RESUMO

Discute-se o tipo de contrato de trabalho que deve ser proposto ao gestor (agente) de uma empresa pelo proprietário, no caso da formação de alianças estratégicas, considerando o ciclo de vida da sua indústria. O problema da agência pode surgir entre os gestores e os proprietários, porque as acções dos gestores podem não ser intrinsecamente não-observáveis em alianças estratégicas. Sugere-se um conjunto de propostas e modelos baseados principalmente nos vários níveis de incerteza dominantes no sector. Globalmente, o modelo proposto mostra que nos estádios mais avançados da indústria, os proprietários estão em melhor situação, oferecendo o contrato em que os agentes recebem um pagamento fixo (i.e. a primeira melhor solução), visto que, em fases de crescimento, os gestores recebem um pagamento fixo e um prémio de desempenho adicional (a segunda melhor solução). Em ambos os casos, os proprietários recebem o residual.

Palavras-chave: Teoria de Agência, Alianças Estratégicas, Elaboração de Contrato de Trabalho, Ciclos de Vida da Indústria

INTRODUCTION

Businesses seek different organizational forms in order to increase efficiency and to create competitive advantages. While researchers have studied thirteen basic types of organizational relations, strategic alliances have outnumbered many existing organizational forms (Todeva and Knoke, 2001).

Strategic alliances are voluntary cooperative agreements where two or more firms pool resources to improve the competitive position and performance of firms (Koljatic and Silva, 2007) . Alliances are considered complex organizational types and are identified as incomplete contracts that leave all much room for maneuver and interpretations by the firms (Anand and Khanna, 2000). The decision to enter such complex organizational agreements may require changes, or even the total dismantling of existing relationships and mutual obligations between employees and their firms.

Strategic alliances have been a fertile area for researchers in the strategic management literature. Accordingly, there have been numerous attempts to explain the unprecedented growth in the number of inter-firm alliances (Child and Faulkner, 1998; Gulati, 1998). Prior research has focused mainly on documenting growth in the number of alliances and identifying the environmental and firm specific factors that lead to alliance formation. However, to the authors knowledge, little research has been done in order to explore the question of employee (agent) contracts and their relationship with different organizational forms such as strategic alliances. Therefore, in this paper we look into this fairly untouched stream of literature and ask the question, What is the optimum employment contract design in the decision to enter a strategic alliance?

In providing explanations to the above research question, we mainly build on agency theory. Agency theory has crucial implications for corporate governance and choice of corporate governance structure especially when this choice entails some outcome uncertainty and risk (Eisenhardt, 1989). Das and Teng (2000) pointed out that managers are often motivated to fold the alliances into their own firms to control their own compensation and employment risk that increases agency costs. A consequence is that many alliances are terminated quite quickly or often sold to another partner. Therefore, this study is an important contribution to the strategic alliance literature in that it offers a contract design that would decrease agency costs while increasing the chance of obtaining successful outcomes.

Agency theory tries to explain the relationship between the principal (owner) and agent (manager) and is concerned with the monitoring ability of the principal in the case of different levels of actions of the agent. Following the past literature, we assume in this paper that the agent has an information advantage over the principal in obtaining resources and seeking to exploit his/her relative positions, and thus must be presided over by the principal (Fama and Jensen, 1983; Jensen and Meckling, 1976). Moreover agents will have further incentives to enter strategic alliances since the literature has shown that the markets react positively to the announcements of strategic alliances (Marciukaityte, Roskelley and Wang, 2008). Principals can be risk averse, risk neutral and risk loving, according to their risk preferences and the shareholders or owners role in the firms. In our setting, the principal can be either the owner or the shareholder, but prepares the contracts for the manager (agent) employment. Our assumptions within the framework of agency theory are not very different from the transaction cost theory, since managers are seen as self interested, opportunistic, subject to bounded rationality, and risk averse (Williamson, 1981). Transactions cost theory also argues that the specific assets invested in a partnership increase the hazard of opportunism (Lui, Wong and Liu, 2008). Therefore, the existence of strategic alliances as organizational forms can be seen as an opportunity by the manager to exploit that of a larger and thus less observable business environment. In this setting, monitoring the behaviors of the agent becomes difficult and therefore the principal may be faced with serious adverse selection and moral hazard problems. Moreover, firms may still have potential to benefit from strategic alliances through synergy creation and increased efficiency in their operations. This trade off must be taken into account by the decision makers in particular, both principals and agents, when forming strategic alliances. Accordingly, by offering the proper employment contract that reduces opportunistic behavior, firm performance will also increase (Lui et al., 2008).

The decision to offer the optimum contract design might be blurred especially when different levels of uncertainty are taken into account. Looking into the industry life cycles (Porter, 1980) enables us to theorize those various levels of uncertainty facing decision makers. We considered effects of different stages of the industry, and hence the associated levels of uncertainty, namely the growth and the mature stages representing the early and the later stages, on the decision to form a strategic alliance. In that sense, industry life cycles are proposed to create an environmental condition that would lead principals or agents, who make the decisions, to ally within that specific context. As a result, we suggest that this paper addresses one of the important gaps not only in the strategic alliance, but also in the agency theory literature and gives ideas about some future research directions.

THEORY AND PROPOSALS

Alternative Perspectives on Agents Behaviors

Agents (managers) are the decision makers for the future operations of the firm (Lambert, 2001). They prepare the investment portfolio before proposing these alternatives to the principal in order to get funding. Agents actions are affected by their decision set. Therefore, the form of their decision-making affects the future performance of the company that they are working for. Within the early economists model of decision-making, the concept of self interest plays a major role, while explaining the rules of rational behavior. Moreover, individual choices combining self interest with the revealed preferences (personal utility) are currently the basis of rational choice theory and models based on rational choice. The notion of rational choice and the framework that the rational choice researchers have generated enables the utilization of a persons beliefs and preferences with well defined probability distributions and utilities and thus builds upon the maximization of expected utilities (Arrow, 1987).

While there is a contrast between the economic models and human choice behavior (Cyert and March, 1963), agency theory tries to minimize the behavioral uncertainties of managers by increasing the control mechanism. This suggests that employment contracts are designed to decrease agents behavioral deviations from optimum output and to ensure that they behave according to the favor of the principals. This outcome increases the wealth of the principal and decreases potential agency problems and related costs. As a result, employment contracts play a significant role in the order of sustaining the optimal equilibrium output.

Agency Theory and Modeling Employment Contracts

Generally there are two aspects of agency problem; moral hazard and adverse selection. Moral hazard is the unobservable action situation, in which the agent does not provide full effort as promised, such as shirking. The adverse selection exists in situations where the agent misrepresents her/his ability (Eisenhardt, 1989). Adverse selection occurs because the principal cannot always observe and verify the agents skills. In this unobservable behavior setting the principal may set several kinds of monitoring systems and hence prepare a contract that adjusts output such as revenue or net income to get the right amount. In this study, we propose optimal employment contract designs to maximize the wealth of the principals. Contracts are written by the principals and proposed to the agents, and then agents either accept or reject (leaves) the employment contract. In the moral hazard model, principals are generally risk neutral and agents are risk averse.

The basic agency theory in our setting is as follows:

The principal is risk neutral and supplies capital to bear risk and construct incentives through the employment contract. The agent is risk averse and makes decisions on the principals behalf. In our case, the agent searches for strategic alliance investment opportunities and then submits his/her business plan, including detailed funding needs, etc., to the principal.

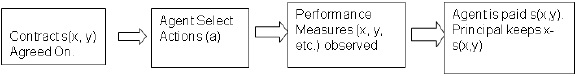

The basic sequence of our model that is adapted from Lambert, 2001 is as follows:

FIGURE 1 - The basic agency model

Where s is the compensation function; y is the performance measure that will be used in the compensation function based on the contract the agent chooses, action, a, which includes operating decision, financing decision and investment decision. These decisions affect the outcome of the firm, x. We assume that x is measured in monetary terms in order to make the analysis simple and understandable.

Our model, the decision to form a strategic alliance, is one of the important applications of agency theory with private information. Antle and Fellingham (1997) analyze a capital budgeting model in which the agent receives private information about the profitability of investments, such as strategic alliances in our case. The agent obtains all the information required to invest in a particular cash flow to project, x. The minimal investment amount necessary to create cash flow x is mx where the value of m is greater than zero. As we discussed earlier, the principal is mainly the fundraiser from the public (banks, shareholders, employees, or own resources). The agent then uses available funds to allocate several investment projects either in the form of a strategic alliance investment or not. A strategic alliance investment decreases the risk of the projects failure, thus increasing the probability of the firms success and positive cash flows. This positive cash flow may increase the compensation of executives through bonuses and etc, which is not the purpose of this paper in particular (i.e. how they are compensated). This would be a possible extension our study.

Lets assume z is the portion of the amount of funds that will be transferred from the principal to the agent for use in a strategic alliance investment. This amount covers not only investments but also the agents compensation. The agency problem starts at this point since the agent can decide to divert a portion of z for his private benefit without revealing the amount of funds needed for the strategic alliance investment. The principal needs information technology to receive the signal about the managers actions/type. According to prior literature, the cost of the signal from low to high is in m1<m2< ..<mn where m1 is the lowest cost and mn is the highest cost of information. The ex-ante probability that the cost of the signal is is represented by gi.

As pointed out above, the principal is assumed to be risk neutral but, unlike the above basic agency theory setting, the agent is also risk neutral. This is because they are open to different alternative investment relationships with other companies that require some level of risk taking by managers. In other words, going together is less risky than going alone. The principals utility is the output minus the resources transferred to agent, x-z. On the other hand, the agents utility is the amount of resources that is transferred minus the amount invested in the production process in the alliance, z-mix. This amount covers both the compensation of the agent and what he consumes. The agents reservation utility is H. The agent either accepts the employment contract or leaves; therefore an employment contract must be designed so as to keep the agent with the company at a minimum cost while maximizing the total benefit for the owners and shareholders.

Strategic alliance investment is a multi-period type of game (in the agency theory setting). As firms get the benefit of the strategic alliance collaboration in the subsequent periods, the dependence on the outcome/benefit of the relationship continues. More specifically, this setting gives the principal the opportunity to obtain more information about the agents actions. On the other hand, investments are usually funded after the employment contract is signed; therefore designing contracts becomes a significant issue for the principal since managers may still exploit her/his relative information advantage by taking strategic alliance investment decisions that may increase information risk (Cready and Demirkan, 2009).

First best solution type of contract

When we assume that costs of signals (information) are publicly observable, the agent does not have a private information advantage. In this case, we can achieve the first-best solution as an optimal contract design. In this setting, the optimal contract takes the form of the agent receiving a fixed payment and the principal getting the residual outcome (Shavell, 1979). The uncertainty that is related to the principal-agent relationship can be eliminated if the action of the agent has a certain outcome. Mirrlees (1976) indicates that there are two conditions in which the first best solution can be attained: there is some chance that the principal will discover the agents choice of action and the principal will arbitrarily impose large punishments on the agent. In this setting, the equilibrium agent chooses appropriate action to avoid punishment and dismissal from the company. The agent does not have any incentive to cheat the principal in strategic alliance investment funding, since his/her incentives align with those of the principal. Holmstrom (1979) mentions that penalty imposed contracts are not optimal and do not continue, therefore the lowest penalty possible is considered in the contract. Prior literature also showed that first best employment contracts tend to result either the agents zero efficiency or infinite efficiency, since the agent only receives his/her reservation utility or leaves the firm, and the principal maximizes his/her wealth.

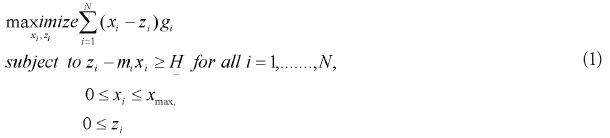

We model the principal problem as follows:

We maximize the principal wealth by finding the optimal level of funding amount and output in the objective function, subject to three constraints. The first constraint indicates that the principal gets an acceptable level of utility regardless of the signal observed. The second constraint places bounds on the allowable output. The last constraint tells us that funds transferred to the agent are greater than or equal to zero. This means that the agent does not have enough wealth to fund the strategic alliance investment himself/herself, and needs funding from the principal.

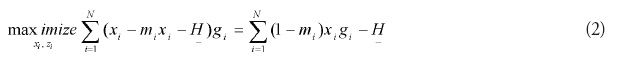

We structured the above linear programming for the principal, and in each cost realization the agent gets just enough resources for the alliance formation and desired outcome and then with the rest covers his reservation utility. The solution is . If we substitute this into our objective function we obtain the solution system below.

The objective function is the linear function of , as seen below:

That is, we only approve the strategic alliance investment decision if the cost is less than 1. Resources are allocated as:

For each signal of the production cost per unit cost of production m, the agent receives enough compensation to cover the required level of funding for the investment plus his reservation utility. The agent gets no slack in either case. From the above conditions, we can see that the agent does not need to enter into a strategic alliance investment to get private benefit because he receives his reservation utility in either case. The only reason they enter a strategic alliance relationship is to increase the principal´s benefit of using opportunities that are linked to this investment decision, and to exploit their relative information environment later on if possible. Both the principal and the agent know that monitoring becomes difficult in a new organizational structure; therefore, the agents employment contract must be designed in order to decrease the cost of lack of monitoring. Strategic alliances may benefit managers by making them better known and improving their reputation, empire building, and entrenchment (Jensen, 1986).

Second best solution type of contract

In general the solution to the agency problem is second best because of the agents information advantage .Therefore we have to consider second best type of employment contracts in order to get required output and action from the agent. Holmstrom (1979) indicates that the optimal contract where there is incomplete information differs from the contract for the following conditions: the agents disutility of effort increases the level of effort, ; the cumulative distribution of outcomes, is non-increasing in the level of effort and strictly decreasing for some outcome value and, the support of the distribution of outcomes does not change with the agents effort. Uncertainty about the agents actions results in second best kinds of solution that strategic alliance investment may increase. If we base the compensation of the agent on her/his effort over a certain time period, we may increase the agents efficiency in favor of the principal. The other option is to provide a menu of incentives that may increase the probability of the manager behaving optimally.

Suppose we offer a first best employment contract to the agent and, if he has private information, the principal cannot force him to obey the contract as he does not report truthfully. If the agent observes signal and reports , he will obtain resources according to the second signal and the agent problem begins to . His cost limit, s, is less than or equal to 1. If the actual cost of the alliance is greater than 1, he does not have an incentive to lie since the project will not be financed by the owner anyway. When the agent has private information and there is uncertainty for different reasons, we design a second best employment contract. In this setting, the principal is aware that the agent will manipulate the reports and therefore puts this option in the employment contract. The problem becomes what kind of employment contracts have to be offered to the agents in which conditions.

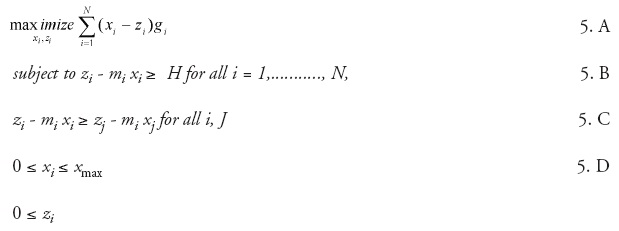

In this setting, the principal problem becomes:

Constraint C is the truth telling constraint; it requires that when the agent observes mi it is better for him to produce or choose the alliance relation accordingly, which is (xi , zi). Adding constraints results in the decrease in the agents slack or excess fund; therefore, the employment contract must be detailed in an uncertain environment if there is a possibility of a strategic alliance investment decision. This increases the chance of strategic alliance success in favor of the principle. The solution to the principal problem has a simple structure. There is a threshold level of cost for the strategic alliance investment decision. x is the observable output of the alliance. Moreover, the strategic alliance has unobservable benefits in the short run, but these outcomes will be realized in the long run and theagent will be compensated accordingly at that time.

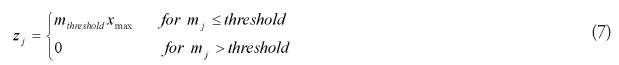

The threshold level of j:

The resources that are provided are:

If we interpret the above results, the agent gets all cost realizations below the threshold level; therefore, slack becomes endogenous for this programming. These threshold levels can be determined and mentioned in the employment contract, and this contract design may prevent agents from becoming too involved in self-interested strategic alliances.

The Role of Uncertainty

Prior research on organizational environment classifies environmental conditions based on different levels of uncertainty (Aldrich, 1979; Milliken, 1987; Lant and Mezias 1990). In parallel with these numerous classifications, researchers have used different phrases to represent such environmental uncertainty, such as stable/turbulent, unambiguous/ambiguous, or predictable/unpredictable (Lin, 2002).

The level of uncertainty in the business environment has important effects on organizational decision making. Organizational concerns and priorities might differ with changing contextual variables. Thus, we suggest that the decisions are also based on changing environmental uncertainty levels.

In its simplest form, uncertainty is defined as the state in which the probability distributions and possible environmental conditions are unknown (Conrath, 1967). The literature suggests the level of uncertainty might differ. Lant and Mezias (1990) differentiate between low and high uncertainty environments. A low uncertainty environment is one in which the predictions on performance, resource and survival implications for firms are accurate and true. On the other hand, a high uncertainty environment is the state in which firms cannot foresee or predict their actions precisely. Similarly, Scott (1998) and Brews, and Hunt (1999) distinguished low and high uncertainty environments based on their predictability.

Industry life cycles might be associated with the environmental uncertainty level in which the firms are operating. Industrys early growth stages are characterized with high environmental uncertainty prevailing from an unstable institutional and regulatory context. Moreover, the uncertainty of the business environment in the growth stages is also strong due to the high entry and exit rates in the industry; therefore, it may be difficult for firms to predict the results of their investment strategies. In addition to this, early growth stages of the industry life cycles are characterized by high transaction costs since contract enforcement, communication, and information disclosure are also weak during these stages (Khanna and Palepu, 1997). Overall, the early growth stages of the industry can be characterized by high uncertainty levels, high entry and exit rates, an unstable institutional and regulatory context, and by information unavailability that contributes to high levels of unpredictability.

We argue that, information becomes very important for the success and the associated competitiveness of the strategic alliance in industries that are characterized by high uncertainty. Accordingly, from a relational perspective (Dyer and Singh, 1998) the firms network relationships represent critical avenues for the acquisition of information and resources necessary for the firms survival and growth (Gulati, 1998). Such an uncertain setting will lead the principal to decide within the existing network based relationships. Existing relationships will enable the principal to acquire information more easily than through the market channels. The social context provides the information to reduce uncertainty. Thus, if uncertainty is high and information is ambiguous, existing relationships can become a unique source of the alliance partners capability and reliability. In addition, the structural positioning of certain actors within the network can also become a signal of how members occupying the same position are likely to behave. This positioning could also become a major source of information during environmental uncertainty.

In the growth stages of industry lifecycle, the uncertain environmental context impedes the availability of information and hence the computation of associated costs and benefits. A decision based on optimum returns such as the cost minimization and value maximization becomes out of context. The principal does not learn all information about the strategic alliance investment opportunities, but the agent does and thus has a private information advantage over the principal.

Based on the above reasoning, we propose:

P1: In growth stages of the industry lifecycle, where industry is characterized by high levels of uncertainty,, the principal must propose second-best kind of employment contracts to the agent in order that a successful strategic alliance can be formed in favor of the owner.

As industries grow more mature, the factors leading to high environmental uncertainty start to diminish e.g. the stabilized entry and exit rates, the more mature institutional and regulatory contexts, and increased availability of information. The environmental context becomes more stable and accordingly the predictions on performance and therefore resource and survival implications for firms will become accurate and true. In our model, we do not take into consideration the rates of technological change; we assume they are fixed in mature industries for simplicitys sake. On the other hand, uncertainty due to technological change is much lower in mature than in premature industries, since they are able to safeguard themselves through different types of contracts with their suppliers. In unambiguous, stable environments principals will have more predictive ability and be able to assess most of the options available and monitor the agent accordingly. Therefore, all the information the agent knows is also available to the principal. In mature stages, strategic alliances may not increase uncertainty because of the firms boundaries are better defined than in growth stage scenarios.

As a result, we propose the following:

P2: In mature stages of the industry lifecycle, where industry is characterized by lower levels of uncertainty, the principal may propose first-best kind of employment contracts to the agent so that a successful strategic alliance can be formed in favor of the owner.

Industry Life Cycle and Competitive Structure

The industry life cycle in which the firm operates also affects a firms decision to enter strategic alliances, especially through the competitiveness of the environment that it creates and the associated competitive uncertainty (Khanna, Gulati and Nohria, 1998).

The competitive structure of industries in a mature stage is generally characterized by intense competitive threats (Porter, 1980). Thus, in the mature stage of the industry high payoff levels for the corporation are likely to exist. Moreover, due to the competitive nature of the market, margins are low and products are difficult to differentiate. Firms in these types of industry have to make quick decisions and adapt to changing market structure in order to survive. However, organizational inertia and the constraints that administrative heritage brings (Hannan and Freeman, 1989) might impede the principals decision making abilities based on economic perspectives. An evaluation must therefore be made of all available information and opportunities assessed in order to reach the optimum; this could be time consuming in an industry context where the organization needs quick access to capabilities so as to cope with the changing competitive conditions. Therefore, it might be impossible to evaluate all available information under highly competitive, mature stage industries essentially because decision makers may not be fully informed about the available options and alternatives.

Even if the organizations have full information they might not have the necessary capabilities to assess that information due to the competitive nature of the industry context. Thus, in the mature stage of the industry, it is more likely that the agent makes the decision to form a strategic alliance based on their networks and past alliance relationships (Kogut, 1989; Gulati, 1999).

The principals decision, based on their social ties, not only enables firms to make quick decisions, but also to enhance their legitimization, gain firm visibility, signal enhanced status, and access capabilities that the environment requires (Baum and Oliver, 1991; Kogut, 1988). This kind of decision to enter an alliance can also help distinguish firms from other competitors, which is especially important in crowded and competitive markets. This industry structures give the agent an information advantage. Since less competitive environments are suggested to be the reason for agency costs (Dahlstrom et al., 2008), the agent may be inclined to misrepresent her/his abilities or give the principal wrong signals. As a result, we suggest the following proposal:

P3: In mature stages of the industry life cycle where competition is strong, the principal must propose a second best kind of employment contract to the agent with additional constraints so that a successful strategic alliance can be formed in favor of the owner.

In growth stage industries, firms have resources from past investments and knowledge that have been built up over time and can be enhanced by entering new alliances (Eisenhardt and Schoonhoven, 1996). Hence, speed and flexibility, as opposed to mature stage industries, are not critical in these types of industry. Thus the principal is better able to assess the industry position and available opportunities in growth stage industries. Therefore, we propose that:

P4: In mature stage industries, where competition is weak, the principal must propose first-best kind of employment contracts to the agent so that a successful strategic alliance can be formed in favor of the owner.

DISCUSSION AND CONCLUSION

Strategic alliances are organizational forms that are desired both by the owners (principals) and their managers (agents). However, in the case of strategic alliances, there may by agency problems because of the agents private information that the principal cannot observe. In this study we suggest that owners (principals) choose the optimum employment contract in the case of the agents decision to form strategic alliances by taking into account the various levels of uncertainty from industry life cycles and competitiveness, and also from uncertainties associated with the strategic alliance itself.

The set of models proposed suggests that employment contracts based on the information provided by the industrys social ties results in two types of employment contract designs. In addition, the level of risk and uncertainty prevailing in the industry may determine which alternative to choose when agents propose the decision to form strategic alliances. The two employment contract designs we consider are first best and second best employment contract models.

Our model shows that in mature stages of the industry characterized by lower levels of risk and uncertainty, principals are better off offering a contract where agents receive a fixed payment (i.e. the first best solution). First best employment contract designs would lead to more sustainable growth and positive alliance performance in mature industries. On the other hand, in growth stages agents should get fixed payments with additional performance pay such as bonuses (i.e. the second best solution). Our paper suggests that principals need more monitoring mechanisms when higher levels of risk and uncertainty characterize the industry. Therefore, second-best employment contracts enable firms in industries in growth stages find a means of sustainable growth sustainable in a rapidly changing and competitive environment.

Several limitations of our study warrant further research in this area. First, other mechanisms which may be social may deal with the informal asymmetries, e.g. reputations or long term oriented career expectations (Arrow, 1987; Pratt and Zeckhauser, 1985). Second, the case where agents are risk-neutral also warrants study (Levinthal, 1988).

Overall and despite some limitations, the models proposed in this paper constitute fertile ground for combining the literature on agency theory and organizational theory. We argue that our suggested model will give researchers a broader picture of alliance formation and designing employment contracts, bearing in mind the importance of the relationship between the principal and the agent, and the effect of the industry life cycle on the principal-agent relationship in the strategic alliance investment decision.

Little research has been done to explore the dynamics of agency theory aspects of strategic alliance formation within the context of the industry lifecycles. Specifically, we contribute to the literature by pointing out the possible agency problem between the owners and their managers who oversee the benefits of investments in the case of strategic alliances. We investigate the perspectives in which investment decision making in alliance formation is based within the context of the industry lifecycle. We also contribute to the exiting literature by suggesting the specific employment contract design for the executives, thereby offering an applicable outcome.

REFERENCES

ALDRICH, H.E. (1979), Organizations and Environment. Prentice-Hall, Englewood Cliffs, NJ. [ Links ]

ANAND, B. & KHANNA,T. (2000), «Do firms learn to create value? The case of alliances». Strategic Management Journal, 21, pp. 295-315.

ANTLE R. & FELLINGHAM, J. (1997), «Model of capital investment with private information and incentives: a selective review». Journal of Business Finance and Accounting, 24, pp. 887-908.

ARROW, K. J. (1987). Economic theory and the hypothesis of rationality. The New Palgrave: A Dictionary of Economics , NJ .

BAUM, J. A. & OLIVER, C. (1991), «Institutional linkages and organizational mortality». Administrative Science Quarterly, 36(2), pp. 187-219.

BREWS, P. J. & HUNT, M. R. (1999), «Learning to plan and planning to learn: resolving the planning school/learning school debate». Strategic Management Journal, 20(10), pp. 889-913.

CHILD, J. & FAULKNER, D. (1998), Strategies of Co-Operation: Managing Alliances, Networks, and Joint Venture. Oxford University Press, NY.

CONRATH, D. W. (1967), «Organizational decision making behavior under varying conditions of uncertainty». Management Science, 13(8), pp. B487-B500.

CREADY, W. M. & DEMIRKAN, S. (2008), «Information characteristics of strategic alliances». Working Paper, University of Texas at Dallas and SUNY - Binghamton.

CYERT, R. M. & MARCH, J. G. (1963), A Behavioral Theory of the Firm.Prentice-Hall, Englewood Cliffs, N.J.

DAHLSTROM, R. H.; SVEN, A.; NYGAARD, A. & ROKKAN, A.

DAS, T. K. & TENG, B. A. (2000), «Resource based theory of strategic alliances». Journal of Management, 26(1), pp. 31-61.

DYER, J. & SINGH, H. (1998), «The relational view: co-operative strategy and sources of interorganisational competitive advantage». Academy of Management Review, 23(4), pp. 660-679.

EISENHARDT, K. M. (1989), «Agency theory: an assessment and review». Academy of Management Review, 14, pp. 57-74.

FAMA, E. & JENSEN, M. (1983), «Separation of ownership and control». Journal of Law and Economics, 26, pp. 301-325.

GULATI, R. (1998), «Alliances and networks». Strategic Management Journal, 19(4), pp. 293-317.

GULATI, R. (1999). «Network location and learning: the influence of network resources and firm capabilities on alliance formation». Strategic Management Journal, 20, pp. 397-420.

HANNAN, M. T. & FREEMAN, J. (1989), Organisational Ecology. Harvard University Press, Cambridge, MA.

HOLMSTROM, B. (1979), «Moral hazard and observability». Bell Journal of Economics, 10, pp. 74-91.

KHANNA, T. & PALEPU, K. (1997), «Corporate strategies for business groups in emerging markets». Harvard Business Review, July-August.

KOGUT, B. (1988), «Joint ventures: theoretical and empirical perspectives». Strategic Management Journal, 9(4), pp. 319-332.

KOGUT, B. (1989). «The stability of joint ventures reciprocity and competitive». The Journal of Industrial Economics, 38(2), pp. 183-199.

KOLJATIC, M. & SILVA, M. (2008), «Uncertainty reduction mechanism in cross-sector alliances in Latin America». Journal of Business Research, 61, pp. 648-650.

LAMBERT, R. A. (2001), «Contracting theory and accounting». Journal of Accounting and Economics, 32, pp. 3-87.

LANT, T. K. & MEZIAS, D. S. J. (1990), «Managing discontinuous change: a simulation study of organizational learning». Strategic Management Journal, 11, pp.147-179.

LIN, Z. (2002), «A computational exploration of dynamics of strategic alliance formations: theory and practice». Working Paper, UTD.

LUI, S. S.; WONG,Y. & LIU, W. (2008), «Asset specificity roles in interfirm cooperation: reducing opportunistic behavior or increasing cooperative behavior?». Journal of Business Research, forthcoming.

MARCIUKAITYTE, D.; ROSKELLEY, K. & WANG, H. (2008), «Strategic alliances by financial service firms». Journal of Business Research, forthcoming.

MILLIKEN, F. J. (1987), «Three types of perceived uncertainty about the environment: State, effect and response uncertainty». Academy of Management Review, 12 (1), pp. 133-143.

MIRRLEES, J. (1976), «The optimal structure of incentives and authority within an organization». Bell Journal of Economics, 7, pp. 105-131.

PORTER, M. (1980), Competitive Strategy: Techniques for Analyzing Industries and Competitor . Free Press, New York.

SCOTT, W. R. (1998), Organizations: Rational, Natural, and Open Systems. Prentice-Hall, Upper Saddel River, NJ.

SHAVELL, S. (1979), «Risk sharing and incentives in the principal and agent relationship». Bell Journal of Economics, 10, pp. 55-73.

WILLIAMSON, O. E. (1981), «The economic organization: the transaction cost approach». American Journal of Sociology, 87, pp. 548-77.