Serviços Personalizados

Journal

Artigo

Indicadores

-

Citado por SciELO

Citado por SciELO -

Acessos

Acessos

Links relacionados

-

Similares em

SciELO

Similares em

SciELO

Compartilhar

Ciência e Técnica Vitivinícola

versão impressa ISSN 0254-0223

Ciência Téc. Vitiv. vol.27 no.1 Dois Portos 2012

Acceptance of national and store brands of wine by supermarket consumers in the South of Chile

Aceitação de vinhos de marcas nacionais e de marcas próprias pelos consumidores em supermercados no sul do Chile

Berta Schnettler1*, Horacio Miranda1, José Sepúlveda1, Nataly Mills1, María José González1, Marcos Mora2, Germán Lobos3

1 Universidad de La Frontera, Facultad de Ciencias Agropecuarias y Forestales. Avenida Francisco Salazar 01145, 4780000 Temuco, Chile.

2 Universidad de Chile, Facultad de Ciencias Agronómicas. Casilla 1004, Santiago, Chile.

3 Universidad de Talca, Escuela de Ingeniería Comercial, 2 Norte 685, 3465548 Talca, Chile.

SUMMARY

The relative importance of brand (traditional national, new or emerging national and store brand), packaging (bottle and tetra-pack) and price on the choice of red wine were evaluated through consumers in Temuco, and consumer segments were also identified in terms of their preferences. 400 direct surveys were applied in September 2010. Of all those surveyed, 79.8% said they drank wine, predominantly occasionally. Brand (60.4%) was more important than price (21.8%) and packaging (17.8%). Three segments were identified: the largest (81.5%) said brand was most important; the second (11%) attributed similar relevance to packaging and price; the third (7.5%) said price was the most important. The groups differed according to socio-demographic characteristics, influences on the decision to purchase and the motives for choosing the brand. Independently of the importance given to brand, consumers preferred the widely known national brands at the lowest price, and rejected the store-brand wine.

Key words: national brands, store brands, market segmentation.

RESUMO

A importância relativa da marca (nacionais tradicionais, nacionais novas ou nacionais e marcas próprias), embalagens (garrafa e tetra-pack) e preço na escolha de vinho tinto foi avaliada através de consumidores em Temuco, e foram também identificados segmentos de consumidores em termos de suas preferências. 400 questionários foram aplicados em setembro de 2010. De todos os inquiridos, 79,8% disseram que bebiam vinho, ocasionalmente. Conclui-se que a marca (60,4%) foi mais importante do que o preço (21,8%) e embalagens (17,8%). Três segmentos foram identificados: o maior segmento (81,5%) referiu a marca como mais importante, o segundo (11%) atribuiu relevância semelhante à embalagem e ao preço; o terceiro (7,5%) referiu o preço como o mais importante. Os grupos diferiram de acordo com características sócio-demográficas, as influências na decisão de compra e os motivos para a escolha da marca. Independentemente da importância dada à marca, os consumidores preferiram as marcas nacionais amplamente conhecidas com o menor preço, e rejeitaram o vinho com marcas próprias.

Palavras-chave: marcas nacionais; marcas próprias, segmentação de mercado.

INTRODUCTION

During the last few years world wine industry has experienced a large growth. In particular, the Chilean wine industry is now one of the most dynamic and important sectors of the country’s economy (Duarte-Mermoud et al., 2010). The wine production increased from approximately 642 to 915 million litres between 2000 and 2010, according to the Agriculture and Livestock Service (SAG, 2011), representing an increase of 42.5%. In the same period exports increased from approximately 267 to 733 million litres (Wines of Chile, 2011), i.e., an increase of 174.5%. In relation to the wine-producing market worldwide, in 2009 Chile was in tenth place among wine producers, representing approximately 3.4% of international shipments. It should be noted that the group of "six new exporters" (Argentina, Australia, Chile, the United States, New Zealand and South Africa) are continuing to improve their market position, reaching a participation close to 30% in 2008. The main destinations of Chilean exports in 2009 were the United Kingdom, the United States, Holland and Brazil. However, despite the importance of exports, the domestic market continues to be of interest because Chile is the country that spends the most dollars per capita on wines in Latin America (Jiménez et al., 2010). In this respect, attention is called to the paucity of studies that deal with the wine preferences of Chilean consumers (Schnettler and Rivera, 2003; Melo et al., 2005; Zamora and Bravo, 2005; Troncoso and Aguirre, 2006; González and Melo, 2008; Cerda et al., 2010; Mora et al., 2010), which have concentrated mainly on the prices, the acceptance of organic wine and the differentiation associated with tourism.

In Chile wine consumption dropped from 68 to 13 litres per capita between 1962 and 1993, recovering up to almost 20 litres per capita by the end of the 1990s, although the current average is approximately 15 litres per capita per year (Jiménez et al., 2010). This trend is similar to the one observed in the main EU producing countries, France, Italy, Spain (Smith and Miltry, 2007) and Portugal (Duarte et al., 2010). Many different factors may contribute to explain this trend, like growing consumer health concerns, changes in population lifestyles, legal constraints related to alcohol consumption, as well as aggressive marketing strategies from the beer and non-alcoholic drink industries, based on innovation and the development of new products (Duarte et al., 2010). Also, the function of wine has been changing from nutrition to pleasure (Hetzberg and Malorgio, 2008; Barrena and Sanchez, 2009), being consumed on special occasions and representing a sort of status symbol, which leads to more occasional drinking (Schnettler and Rivera, 2003; Hertzberg and Malorgio, 2008).

The wine market presents the consumer with a vast array of products and product attributes to consider when making a purchase decision (Dood et al., 2005). There are thousands of brand names, dozens of grape varieties, regions, labels, wine styles and a large range of prices to choose from (Johnson and Bruwer, 2004). Chile is also in this situation: the country has around 180 vineyards with different brand names.

However, a small group of traditional vineyards controls most of the domestic market: Concha y Toro (31%), Santa Rita (29%) and San Pedro Tarapacá (23%), while the remaining 17% is largely spread over vineyards of varying sizes, some of them recently established (Jiménez et al., 2010). In addition, wine has recently been offered as store brands in the country’s main supermarket chains (Jumbo and Líder). The store brands or private labels are generally brands created for, controlled by, and/or sold to retailers (Narasimhan and Wilcox, 1998; Sethuraman and Cole, 1999), while a brand product sold by the manufacturer through retailers is called a national brand (Narasimhan and Wilcox, 1998).

In the decision to purchase, wine is in fact a complex product with different intrinsic and extrinsic attributes playing a role in consumers’ perception of quality (Lockshin and Hall, 2003) and preferences: taste (Lockshin and Hall, 2003, Goodman, 2009; Mueller and Szolnoki, 2010), price (AESBUC, 2003; Plasssmann et al., 2008; Ribeiro and Santos, 2008; Mueller and Szolnoki, 2010), region or designation of origin (AESBUC, 2003; Martínez-Carrasco et al. 2006; Mtimet and Albisu, 2006; Ribeiro and Santos, 2008), brand (AESBUC, 2003; Perrouty et al., 2006; Hertzberg and Malorgio, 2008; Ribeiro and Santos, 2008), packaging (Batt and Dean, 2000; Lockshin and Hall, 2003), aging (Martínez-Carrasco et al. 2006; Mtimet and Albisu, 2006), harvest year (AESBUC, 2003), labelling (Batt and Dean, 2000), among others. However, extrinsic cues play a critical role in the sale of sensory products such as wine since they enable the increase of hedonic pleasure without additional effort or expenditure. These cues have been shown to be the principal evaluative criteria used by consumers during the buying process (Priilaid, 2006; Siegrist and Cousin, 2009; Mueller et al., 2010ab). This is especially true since wine consumers are characterised by low levels of predetermination and thus typically decide on their purchase only when in the store (Seghieri et al., 2007).

Nevertheless, the importance of the attributes differs from country to country. For traditional producers, like Italy and France, the provenance of the wine is considerably more important than brand names or grape varieties (Hertzberg and Malorgio, 2008; Goodman, 2009). Wine brands dominate in markets that are less inclined to employ terroir-units as markers of quality. These so-called new world territories include most of the English-speaking world as well as certain countries in South America and Asia (Jarvis et al., 2003; Robinson, 2006).

Previous research suggests that brands are particularly important for food and drink items because food purchasing decisions are made frequently, and often under time pressure (Bredahl, 2004). Keller (2003) suggests that brands reduce the risks that consumers face when they purchase a product, given that brand helps signal to consumers the level of quality inherent in a product. However, new and unfamiliar brands are riskier than tried and trusted brand names (Varela et al., 2010). Mowle and Merrilees (2005) observe in the main, "despite the vital role that brands play in the successful marketing of wine, there appears to be a paucity of empirical research into branding in the wine industry". Lockshin et al. (2000) highlight the fact that the brand name acts a surrogate for a number of attributes including quality and acts as a short cut in dealing with risk and providing product cues. However, Lockshin et al. (2006) found that brand effect is more important at low prices. By contrast, other authors indicate that the importance of brand in the wine market seems to be lower than in the case of other goods, possibly due to the large number of attributes that define the product (Jarvis et al., 2003). With respect to store brands, Hertzberg and Malorgio (2008) found private labels are not appreciated in the Italian wine market.

Price is perceived by consumers as the most salient attribute in product choice in general (Quester and Smart, 1998) and serves as the most important cue for the quality perception of wine in particular (Mitchell and Greatorex, 1988; Spawton and Lockshin, 2001; Myers, 2003). Previous studies (Lockshin et al., 2006; Lockshin et al., 2009) have identified price as a key driver of wine choice. Price is particularly significant when intrinsic cues such as wine fl avour are not available in the pre-purchase stage (Mitchell and Greatorex, 1988) and is utilised by consumers as part of their risk reduction strategies. Higher prices tend to represent a cue for product quality (Schnettler and Rivera, 2003; Lockshin et al., 2006; Priilaid and van Rensburg; 2010). Oczkowski (2001) suggested that wine prices depend on quality, reputation and objective characteristics. Plasssmann et al. (2008) found a direct impact of wine price on liking. Hollebeek et al. (2007) suggested that consumers who tend to undertake relatively extensive wine brand selection processes would be more likely to be willing to pay higher wine prices compared to those who choose their wines relatively casually.

Both industry and academic research suggest that wine appearance and packaging play important roles in consumer perceptions and choices, especially as the first taste is almost always with the eye (Mueller et al., 2010c). Wine researchers have recently begun to study packaging (Barber et al., 2006; Orth and Malkewitz, 2008). In general, packaging attributes provide consumers with social and aesthetic utility and strongly influence expectations of sensory perception (Lange et al., 2002; Jaeger, 2006). Despite research that suggests that packaging affects product evaluations (Batt and Dean, 2000, Orth and Malkewitz, 2008), findings about the relative importance of wine packaging compared with other extrinsic product cues like brand name, region, country of origin and price offer contradictory evidence about its influence. For example, Goodman (2009) and Mueller et al. (2007) each directly measured the importance of wine attributes and concluded that wine packaging design was relatively unimportant. In a previous study in Chile, Schnettler and Rivera (2003) found that packaging was less important than grape variety and price. In Chile today the most pervasive packaging in the internal market is the tetrapack (57%) due to the advantages that it presents regarding asepsis, easy recycling, low weight, maximisation of the space required for storage and transfer, and its increased shock robustness. In glass (37%) there are three formats on the market, small half-litre bottles, 5-litre bottles and 0.75-litre bottles. It should be pointed out that recently economic packaging has appeared, such as plastic (6%) (Jiménez et al., 2010).

Another aspect to consider in the decision to purchase wine is that the importance of the attributes differs according to the characteristics of the consumer. These include age and gender, which affect the importance of the brand (AESBUC, 2003; Mueller and Szolnoki, 2010; Mueller et al., 2010c), the region of origin (AESBUC, 2003), the packaging (Mueller and Szolnoki, 2010) and the price (Schnettler and Rivera, 2003; Mueller et al., 2010c) in the decision to purchase. In Turkey Guris et al. (2007) found six important factors influencing wine brand preferences: consumers’ reasons for changing brands, occupation, marital status, birthplace, income and gender. In addition, the reasons for buying and consumption behaviour are associated with the consumer’s age (Olsen et al., 2007; Hetzberg and Malorgio, 2008; Barrena and Sanchez, 2009; Duarte et al., 2010).

Based on the above information, the objectives of the present work were: 1) to evaluate the relative importance of brand, packaging and price on the choice of red wine, 2) to determine preferences for traditional national brands, new or emerging national brands and store brands and 3) to distinguish consumer segments by their preferences in Temuco, Araucanía Region, in southern Chile. The study was conducted with red wine because previous studies have indicated that the Chilean consumer prefers red over white wines (Schnettler and Rivera, 2003).

MATERIAL AND METHODS

Sample

A personal survey was carried out on a sample of 400 people, aged over eighteen, who were responsible for buying food and drinks for their households in Temuco (Araucanía Region, 38º45’ S, 73º03’W), Chile. The number of people surveyed was obtained using the simple random sample formula for non-finite populations (N> 100,000; Temuco: 245,347 inhabitants, Census 2002), considering 95% confi dence, 5% of error of estimation and a maximum dispersion (p = q = 0.5), which implies expecting the greatest level of variation of opinion from the total collective on the analyzed theme with respect to the mean value (Fernández, 2002).

Information collection instrument.

The questionnaire used contained closed questions about wine consumption habits in the household, factors that influence the decision to purchase wine, the place where it is decided that the brand will be bought, the reasons that explain the brand choice and post-purchase reaction in the event of dissatisfaction with the product. In relation to store brands, respondents were asked if they knew what it means if a product has the supermarket brand where they buy it. After reading the following definition of store brands: "the store brands or private labels are generally brands created for, controlled by, and/or sold to retailers, but the products are made by companies that package and label with the supermarket brand, even though they may have competing brands on the shelf", they were then asked if they had previously bought store-brand foods or drinks.

Classification questions were included to establish gender, age, family size, area of residence, self-declared lifestyle, occupation and level of education of the head of the household, and ownership of ten domestic goods. The combination of these two latter variables in a matrix allows the socio-economic level to be determined, classified as ABC1 (high and upper middle), C2 (middle-middle), C3 (lower middle), D (low) and E (very low). These variables are conceptually related to income, cultural level and with the stock of wealth accumulated by the family group, allowing a simple but adequate estimate to be made of the socio-economic level of Chilean households (Adimark, 2004).

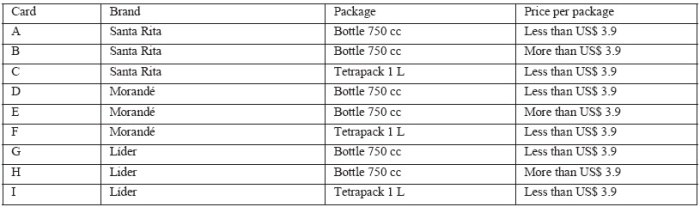

A conjoint analysis (CA) was employed to evaluate the relative importance of brand, packaging and price on the choice of red wine. CA is a decompositional method that allows the relative importance of the attributes of a product to be estimated, as well as the partial utility values for each level of an attribute. The estimated partial utility indicates how infl uential each level of an attribute is in the formation of consumer preferences for a particular combination, i.e. they represent the degree of preference for each level of an attribute (Hair et al., 1999). The levels established for the attribute "brand" was a traditional long-time, well known brand in Chile (Santa Rita, vineyard founded in 1880), a new or emerging national brand from a more recently established vineyard (Morandé, vineyard founded in 1996) and a store brand was from one of Chile’s main supermarket chains (Líder). For the attribute packaging the levels established were 750 cc bottles and 1-litre tetrapack, since these are the most frequently used packages in the country. The levels for the attribute price were: less than US$

3.9 per package and more than US$ 3.9 per package, since the wines priced under US$ 3.9 are related to lower quality and the wines over this price are considered of better quality. The national currency values (Chilean pesos) were converted to dollars using the average 2010 value (Ch$510.25/US$). From these attributes and levels a total of 12 combinations (3 x 2 x 2) were obtained; however because wines are not sold in 1 L tetrapacks for more than US$ 3.9 per package, the alternatives considered for this combination were eliminated. This allowed the number of stimuli to be reduced to nine with one specification for each attribute (Table I). Each respondent ordered the cards with the combination of attributes from most to least preferred, on a scale of 1 to 9, where 1 = most preferred; 9 = least preferred.

TABLE I

Design of the conjoint experiment.

Conceção da experiência conjunta.

Procedure

The survey was applied personally by two previously trained surveyors (fifth year students in the Agronomy programme, Universidad de La Frontera, Temuco, Chile), at the exit of two supermarkets in Temuco in September 2010, the time when wine consumption increases due to the celebration of the national holiday. The choice of the supermarkets to apply the surveys was due to the fact that they constitute the main distribution channel for this product in Chile, concentrating 48% of the volume of wine consumed in litres (González and Melo, 2008). The supermarkets where the surveys were carried out are in the category of "big supermarkets" in Chile (3,000 to 6,000 m2, 1,500 to 10,000 products, 20 tills on average) and attract all types of shoppers. One of the supermarkets selected belonged to one of Chile’s two principal supermarket chains, while the other was a company with a regional presence. The surveyors intercepted people as they were coming out of the supermarkets, explained to them the objectives of the survey and the strictly confi dential treatment of the information obtained, and then asked if they were prepared to answer the questionnaire (mall intercept type). Prior to the application of the survey, the questionnaire was validated by a preliminary test with 10% of the survey sample. As the validation of the instrument was satisfactory, no changes were required in either the questionnaire or the interview procedure. The participants signed informed consent statements before responding. The execution of the study was approved by the Bioethics Committee of the Faculty of Farming, Livestock and Forestry Sciences of the Universidad de La Frontera.

Statistical analysis

A conjoint analysis was carried out using the SAS TRANSREG procedure (SAS Institute Inc., Cary, NC, USA). The relative importance that consumers gave to the different attributes and the utility values obtained for each level of the selected factors were determined. A hierarchical cluster analysis was chosen to determine consumer segments according to the importance of the attributes and partial utility scores of the levels of the attributes. Ward’s procedure, which calculates the squared Euclidean distance, was carried out with the SAS CLUSTER procedure. The number of clusters was taken on the basis of the R2 obtained and from a strong increase produced in the Cubic Criterion of Clustering and Pseudo-F values. To describe the segments, a Chi-square test was applied for the discrete variables and a single-factor analysis of variance for the continuous variables. Because the Levene’s statistic indicated non-homogeneous variances in all the continuous variables analysed, the variables for which the analysis of variance resulted in significant differences (P < 0.001) were subjected to Dunnett’s T3 Multiple Comparisons test.

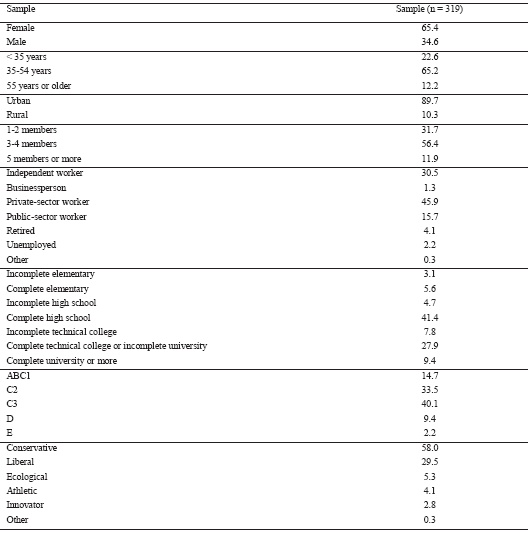

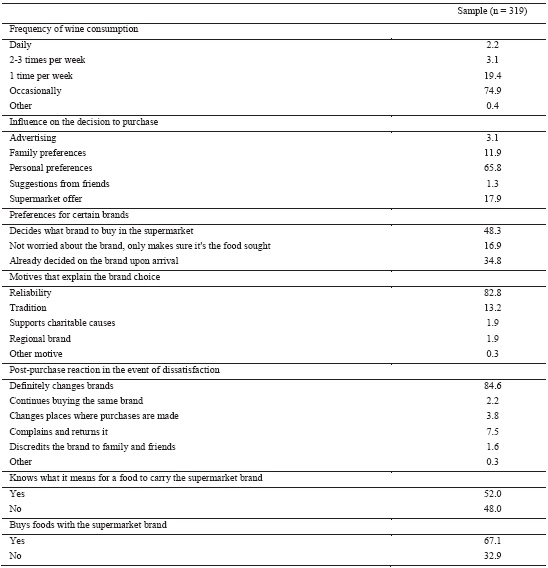

RESULTS

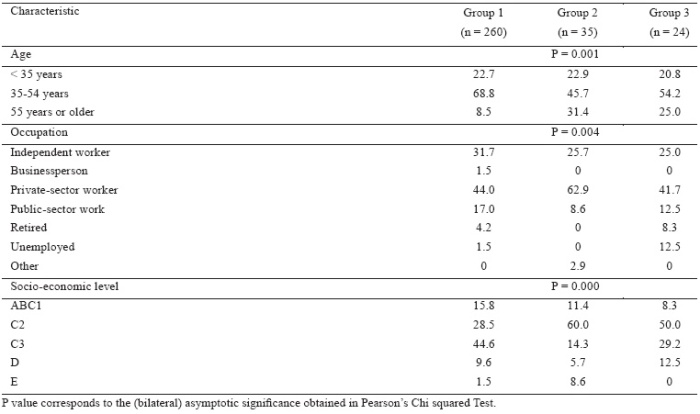

Of all the surveys applied (n = 400), only 79.8% of respondents indicated that they consume wine (n = 319), so it was decided to work with this sample size. Table II presents a description of this sample. The largest proportion of the sample consisted of women (65.4%), aged between 35 and 54 years (65.2%), resident in urban areas (89.7%), with family groups consisting of three to four people (56.4%), independent worker (30,5%) and private-sector worker (30.5%), with complete secondary education (41.4%), belonging to the middle-low (40.1%) and middle-middle (33.5%) socioeconomic level and with a conservative lifestyle (58.0%). The greatest proportion of participants consume wine occasionally (74.9%, Table III, choose the purchase based on personal preferences (65.8%), decide what brand to buy in the supermarket (48.3%) and choose the brand that they trust (82.8%). In case of non-conformity with the product acquired, a high proportion reacts definitively by changing brands (84.6%). Only 52% know what it means that a product has store brand,

TABLE II

Characteristics (%) of the sample. Temuco, Chile. September 2010.

Características (%) da amostra. Temuco, Chile. Setembro de 2010.

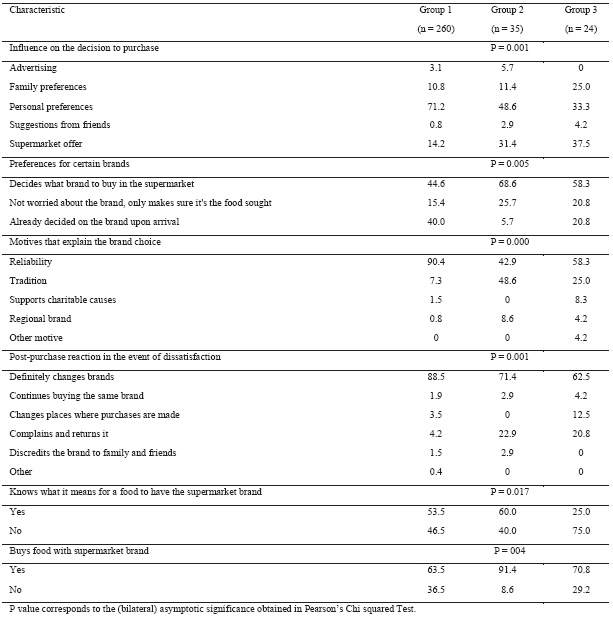

TABLE III

Consumption behavior and decision making process characteristics (%) of the sample. Temuco, Chile. September 2010.

Comportamento de consumo e características do processo de tomada de decisão (%) da amostra. Temuco, Chile. Setembro de 2010.

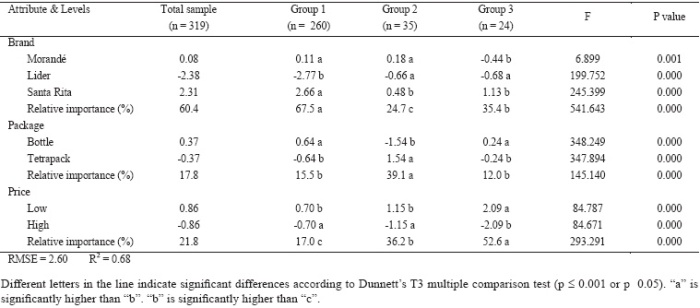

In the total sample, the results of the conjoint analysis indicate that the consumer’s choice is dominated by the brand of wine. The importance given to price (21.8%) was slightly higher than that given to packaging (17.8%). The signs of the utility of the traditional national brand and new or emerging one indicate consumer preference for these; however, the higher number corresponding to the traditional national brand (Santa Rita) indicates greater preference for it. The negative utility towards the store brand (Líder) indicates a lower preference for or rejection of it. At the same time there was evidence of a preference for bottled wine at the lowest price (Table IV).

Distribution and relative importance for the three clusters and overall sample based on preferences for wines and monthly expenditure on food.

Distribuição e importância relativa para os três grupos e amostra global com base nas preferências para os vinhos e as despesas mensais com alimentação.

Using cluster analysis three groups of consumers could be distinguished, presenting statistically significant differences in the importance of the attributes and preferences for all attribute levels (P ≤ 0.001) (Table IV). In addition, the groups presented significant differences according to age, socioeconomic level, influences on the decision to purchase, reasons to explain brand choice, post-purchase reaction in the event of non-conformity (P ≤ 0.001), occupation, the place where it is decided that the brand will be bought, knowledge about what it means that a food has a store brand and if store-brand products are purchased regularly (P ≤ 0.05) (Tables V and VI).

Demographic and consumption behavior characteristics with significant differences in the groups of buyers identified by cluster analysis in Temuco. Chile. September 2010.

Características demográficas e de comportamento de consumo com diferenças significativas entre os grupos de compradores identificados por análise de cluster em Temuco. Chile. Setembro de 2010.

Consumption behavior characteristics with significant differences in the groups of buyers identified by cluster analysis in Temuco. Chile. September 2010.

Características de comportamento de consumo com diferenças significativas entre os grupos de compradores identificados por análise de cluster em Temuco. Chile. Setembro de 2010.

The composition of each group is detailed below.

Brand Sensitive (Group 1, n = 260, 81.5% of the sample): This group assigned greater importance to the brand (67.5%) and showed the greatest preference for the traditional national brand, both significantly higher than in the other groups (P ≤ 0.001). At the same time, the value of the utility towards the store brand was the most negative, which implies a greater rejection (Table IV). The "brand sensitive" group presented the highest proportion of people aged between 35 and 54 (68.8%) and belonging to lower middle socioeconomic level (C3, 44.6%) (Table V). The people in this group mostly decided on the drinks they will buy based on personal preference (71.2%), buy products with predetermined brands (40.0%), their main reason for brand choice relates to trust (24.0%), in the event of dissatisfaction with the product purchased they react definitively by changing brands (88.5%) and do not buy store-brand foods and drinks (36.5%) (Table VI).

Sensitive to packaging and price (Group 2, n = 35, 11.0%): This group assigned the greatest importance to packaging (39.1%) and was the only segment that preferred wine in tetrapacks, both with significantly higher than the rest of the groups (P ≤ 0,001). At the same time, this segment assigned moderate importance to price (36.2%), differing signifi cantly from the rest of the groups (P ≤ 0.001) (Table IV). The "sensitive to packaging and price" group presented the greatest proportion of people over 55 years of age (31.4%), independent workers (62.9%) and belonging to the middle-middle socioeconomic level (C2, 60%) (Table V). The people in this group decide what product they will buy based on what is on the shelf in the supermarket (31.4%) and also choose the brand in the supermarket (68.6%). In spite of this, the consumers in this group choose brands based on what they customarily consume (48.6%). In case of dissatisfaction with the product purchased, they react by complaining and returning the product to the store it (22.9%). Unlike Group 1, a high proportion of the consumers in this group (91.4%) indicated that they buy store-brand foods and drinks (Table VI).

Sensitive to price (Group 3, n = 24, 7.5%): the purchase decision of these consumers was dominated by the price (52.6%), with the greater preference towards the lowest price being significantly higher than the other groups (p ≤ 0.001). The second attribute in importance was brand (35.4%), which stands out because it is the only group that rejected the new or emerging national brand. The negative utility towards store brand did not differ from Group 2, but was significantly higher than Group 1, which implies less rejection (Table IV). The "sensitive to price" group presented a higher proportion of people who were unemployed (12.5%) (Table V). Most people in this segment decide what product they will buy according to the supply in the supermarket (37.5%), prefer brands that support beneficial causes (8.6%), in case of dissatisfaction react by changing the supplier (12.5%) and complaining at the store and returning the product (20.8%). This group stands out for the high proportion of people who indicated not knowing it what means that a product has its own brand (75.0%) (Table VI).

DISCUSSION AND CONCLUSIONS

The present investigation focussed on evaluating the relative importance of brand, packaging and price on the choice of red wine in southern Chile, an important country in the production and export of wine from the Southern Hemisphere. In contrast to what happens in the traditional wine-producing countries (Hertzberg and Malorgio, 2008; Goodman, 2009) but consistent with the situation in the so-called new world territories (Jarvis et al., 2003; Robinson, 2006), the results of this study indicate that brand dominated consumer preferences in the choice of red wine, confi rming the vital role that brands play in the successful marketing of wine (Mowle and Merrilees, 2005; Guris et al., 2007). Therefore, in both the total sample and in the most numerous consumer segment (Group 1, 81.5%), brand was the most relevant attribute in the choice, which is in line with the results of Hertzberg and Malorgio (2008) in Italy, who concluded that the most relevant attribute for consumer choices is the firm’s reputation, represented by the producer’s brand. In addition, they partially agree with the results obtained by AESBUC (2003) and Ribeiro and Santos (2008) in Portugal and by Perrouty et al. (2006) in four European countries, who determined that brand is among the most important choice criteria. It must, however, be pointed out that in these latter three studies brand was less important than the region of origin of the wine, an attribute not evaluated in the present study, but which will have to be included in future investigations. In this respect, it should be emphasised that the designation of origin is a relatively new attribute in the Chilean wine market. While the first regulations on the matter in Europe date from the beginning of the twentieth century, in Chile it was only in 1995 that Ministry of Agriculture Decree Nº 464 established vineyard zoning the country and distinguished wines with designation of origin (Peralta, 2008). Contrary to the results of this study, Jarvis et al. (2003) indicated that brand seems to be less important in the wine market than for other goods, possibly due to the small concentration in the wine sector. The great importance placed on brand in this study can be explained by the great concentration of the domestic wine market, since although as in other countries there are many brands available in the market (Johnson and Bruwer, 2004), in Chile 83% of the domestic market is dominated by three vineyards (Concha y Toro, Santa Rita, San Pedro Tarapacá). Nevertheless, it must be made clear that the marked relevance of brand in the consumer choice might be associated with the price levels used in the stimuli of the conjoint analysis. Lockshin et al. (2006) found that brand effect is more important at low prices, which occurs in this study because US$3.9 per bottle is a low price in the Chilean market. As a result, new research will be required to evaluate the relative importance of price and brand at higher prices.

The almost total preference for national or manufacturer’s brands (only Group 3, 7.5%, rejected the new or emerging national brand) and the complete rejection of store brands is consistent with the behaviour previously observed in studies conducted in Chile with milk (Schnettler et al., 2008ab) and tomato sauce (Schnettler et al., 2008b), and with wine in Italy (Hertzberg and Malorgio, 2008). This points to the respondents having used the brand (and not the price) as a sign of quality in order to reduce the risk associated with making an unsatisfactory purchase (Lockshin et al., 2000; Keller, 2003), since private labels or store brands are generally perceived as being of lower quality than national brands (Richardson et al., 1994; Sprott and Shimp, 2004). At the same time, the greatest preference for the traditional national brand (Santa Rita) over the newer national brand (Morandé) is in line with the results of Mueller et al. (2010b), who determined that consumers preferred a known brand to an unknown name. This confirms the results of Varela et al. (2010), who indicated that new and unfamiliar brands reduce risk less than tried and trusted brand names. This is also consistent with the high proportion of participants who indicated that they choose the brands they trust (82.2%).

In the total sample the relative importance of price and packaging was similar, which according to Baker and Burnham (2002) indicates that none of the attributes dominated the consumers’ preferences. This is contrary to the results of several studies that report on the relevance of price as an attribute in the selection of wine (Batt and Dean, 2000; Tustin and Lockshin, 2001; AESBUC, 2003; Schnettler and Ribera, 2003; Perrouty et al., 2006; Lockshin et al., 2006; Ribeiro and Santos, 2008; Lockshin et al., 2009), which has often been identified as one of the main signs of quality in wine (Mitchell and Greatorex, 1988; Oczkowski, 2001; Spawton and Lockshin, 2001; Ling and Lockshin, 2003; Myers, 2003; Schnettler and Rivera, 2003; Lockshin et al., 2006; Priilaid and van Rensburg, 2010), directly influencing wine preference and purchase (Plassman et al., 2008; Mueller and Szlnoki, 2010). However, the low importance assigned to price in the total sample and the largest segment (Group 1, 81.5%) is consistent with the results obtained by Hertzberg and Malorgio (2008) in Italy. They are also in line with the reports by Mtimet and Albisu (2006) and Martínez-Carrasco et al. (2006) in Spain, and by AESBUC (2003) and Ribeiro and Santos (2008) in Portugal, who found that price was much less important than other attributes such as region of origin, brand and ageing. Considering the high proportion of respondents who claimed to consumer wine only occasionally (74.9%) in the present study, it is possible to suggest that the low importance assigned to price must be due to the cost to consume wine not being a significant part of the family budget, and therefore price becomes a secondary attribute in the choice of purchase. The results of the VI Family Budget Survey (INE, 2008) indicated that the monthly expenditure on food (US$ 321) represents on average 22.08% of the total monthly cost in Chilean homes, of which only 0.34% is spent cost on wine (approximately US$ 1). Another possible explanation lies in Chilean wines being recognised nationally and internationally for its good price/quality ratio (ProChile, 2008). This might also explain why the consumers in the total sample and the three identified segments preferred the lower price, indicating in this case that a higher price was not associated with higher quality. The preference for lower price may also be associated with the socioeconomic composition of the sample, comprising mainly middle-middle and lower-middle class (73.6% altogether).

In the total sample as well as in Groups 1 and 2 (92.5%) the relative importance of price and packaging had similar values, which is consistent with those authors who suggest that packaging affects product evaluations (Batt and Dean, 2000; Orth and Malkewitz, 2008), but runs contrary to reports by Goodman (2009) and Mueller et al. (2007), who concluded that wine packaging design was relatively unimportant, which was only seen in the smallest segment (Group 3, 7.5%). The greatest preference for bottled wine (Groups 1 and 3, 89%) concurs with a previous study in Chile, probably because the bottle is associated with greater quality (Schnettler and Rivera, 2003). Nevertheless, it should be pointed out that the behaviour of Group 2, the one that gave greatest importance to packaging (over price) and preferred wine in tetrapacks is contrary to the reports by Schnettler and Rivera (2003), indicating the emergence of a niche market that clearly prefers this type of packaging. However, if it is considered that in Chile the packaging with the greatest presence in the domestic market is the tetrapack (Jiménez et al., 2010), it can be suggested that although the consumers in Groups 1 and 3 prefer bottled wine, they very likely buy wine in tetrapacks depending on the occasion. Hall and Lochshin (2000) found that the importance of the attributes and the wine chosen are related to the situation where the consumer intends to drink the wine. For example, high price was important when a consumer was purchasing wine in order to impress a business associate or to celebrate a special anniversary. Low price was important when the situation was to relax at home alone, or for entertaining at an informal party or BBQ. This might be perfectly be valid for the choice of packaging and brand, considering also that for certain drinks made with wine in Chile (e.g. red or white wine with strawberries, melon with wine, hot wine with oranges, among others) a low-priced wine is normally used, most probably in tetrapack and, if we were to speculate, a store brand. A cluster analysis made it possible to distinguish three market segments with different preferences and a different demographic profile and purchasing behaviour. However, if it is considered that Group 1 represents 81.5% of the sample that claimed to consume wine, it can be suggested that the wine market in Temuco is quite homogeneous with respect to the variables evaluated, and consistent with the results of a previous study (Schnettler and Rivera, 2003). As a result, we have chosen to discuss only the characteristics of the largest segment. From the demographic point of view it was possible to confirm that there is a relation between the importance assigned to brand and the age of the consumer (AESBUC, 2003; Mueller and Szolnoki, 2010; Mueller et al., 2010c), but not with gender, as had been determined by Guris et al. (2007) and Mueller et al. (2010c). The composition of Group 1 is therefore "brand sensitive" with a greater proportion of people between 35 and 54 years, which is consistent with the results obtained by AESBUC (2003) in Portugal, where it was determined that brand was less valued by younger people. It is also in line with what was reported by Mueller and Szolnoki (2010) in Germany regarding older wine consumers being influenced most strongly by brand. Although the differences found in the socioeconomic composition of Group 1 confirm that there is a connection between the income level of the consumer and the preferences for wine brands as determined by Guris et al. (2007) in Turkey, the results of the two studies are not comparable, and therefore new investigations will be required that delve more deeply into this connection. From the point of view of purchasing behaviour, the greatest proportion of people in this group that decide which brand to buy based on trust is c onsistent with the high importance assigned to this attribute according to the results of the conjoint analysis. So it is possible to infer that they trust the brand to reduce the associated risk of making an unsatisfactory purchase, which also explains the greater preference for the traditional national brand (Santa Rita) together with the greater rejection of the wine with the private label (Líder). The latter point is in line with the smaller proportion of people who indicated that they generally do not buy store-brand products. Another interesting aspect of this group was the high proportion of participants who indicated that they go to the supermarket to buy with the brand already in mind, contrary to what Seghieri et al. (2007) found. This points to the existence of loyalty for certain brands, with the high proportion that chooses the brand based on personal preference being worthy of note. At the same time, Group 1 had fewer people who decide which product to buy on the basis of the existing supply in the store, which would partly explain the low importance assigned to price in the decision to purchase. The high proportion of people in this group who, in the event of non-conformity with the product acquired, react definitively by changing brands implies an active attitude to dissatisfaction on the part of the buyer, who takes the private action to stop buying the product or brand. This can also go together with negative communication with the market (Varela, 1991). This implies fewer opportunities for feedback with respect to customer dissatisfaction and poor options for an adequate after-sales service to keep the consumer buying the brand. This is a great challenge for the domestic wine industry because, unlike most food products, the taste of the wine can vary due to the specific vintage, even if the brand and other extrinsic information remains the same (Lockshin et al., 2006).

Finally, the principal limitation of the study is that the sample is not representative of the country’s population distribution, mainly with respect to gender. However, it should be stressed that the sample consisted of people who were responsible for buying foods and drinks for their households, which is consistent with the higher proportion of women surveyed. This reflects the fact that in Chile women are more likely to purchase food than are men, just as in developed countries. If it is considered that wine is a complex product with different intrinsic and extrinsic attributes playing a role on consumers’ quality perception (Lockshin and Hall, 2003), another limitation of the present study lies in the evaluation of only three product attributes. Therefore, new research is needed to evaluate Chilean consumers’ preferences considering more attributes.

REFERENCES

Adimark, 2004. Mapa Socioeconómico de Chile. Adimark, Investigación de Mercados y Opinión Pública. Santiago, Chile. (http://www.adimark.cl). [ Links ]

AESBUC, 2003. Estudo do consumidor português de vinhos. Associação para a Escola Superior de Biotecnologia da Universidade Católica (AESBUC). [ Links ]

Baker G., Burnham T., 2002. The market for genetically modified foods: consumer characteristics and policy implications. Int. Food Agribus. Manag. Rev., 4, 351-360. [ Links ]

Barber N., Almanza B.A., Donovan J., 2006. Motivational factors of gender, income and age on selecting a bottle of wine. Int. J. Wine Bus. Res., 18, 218-232. [ Links ]

Barrena R., Sanchez M., 2009. Connecting product attributes with emotional benefits, analysis of a Mediterranean product across consumer age segments. Br. Food J., 111, 120-137. [ Links ]

Batt P.J., Dean A., 2000. Factors influencing the consumer’s decision. Aust. NZ. Wine Ind. J. Mark. Suppl., 15(4), 34–41.

Bredahl L., 2004. Cue utilization and quality perception with regard to branded beef. Food Qual. Prefer., 15, 65–75. [ Links ]

Cerda A., Torres M.J., García L. 2010. Preferencias y Disposición a pagar por vinos ecológicos de parte de los consumidores de la Región del Maule, Chile. Pan. Socioec., 40, 60-71. [ Links ]

Dodd T.H., Laverie D.A., Wilcox J.F., Duhan D.F., 2005. Differential effects of experience subjective knowledge, and objective knowledge on sources of information used in consumer wine purchasing. J. Hosp.Tourism Res., 29, 3-19. [ Links ]

Duarte F., Madeira J., Barreira M.M., 2010. Wine purchase and consumption in Portugal - an exploratory analysis of young adults’ motives/attitudes and purchase attributes. Ciência Téc. Vitiv., 25, 63-73.

Duarte-Mermoud M., Beltrán N., Bustos M., 2010. Chilean wine varietal classification using quadratic Fisher transformation. Pattern An. Appl., 13, 181-188. [ Links ]

Fernández A., 2002. Investigación y técnicas de mercado. 292 p. Editorial Esic, Madrid. [ Links ]

González J., Melo O., 2008. Uso de modelos hedónicos y de búsqueda para el análisis de precios de vinos en supermercados. Econ. Agrar., 12, 1-14. [ Links ]

Goodman S., 2009. An international comparison of retail consumer wine choice. Int. J. Wine Bus. Res., 21, 41-49. [ Links ]

Guris S., Metin N., Caglayan E., 2007. The Brand Choice Model of Wine Consumers: A Multinomial Logit Model. Qual. Quan., 41, 447-460. [ Links ]

Hall J., Lockshin L., 2000. Using means-end chains for analyzing occasions–not buyers. Australas. Market. J., 8, 45-54. [ Links ]

Hair J., Anderson R., Tatham R., Black W., 1999. Análisis Multivariante. 832 p. Prentice Hall Internacional. Inc., Madrid. [ Links ]

Hertzberg A., Malorgio M., 2008. Wine demand in Italy: an analysis of consumer preferences. New Medit., 4, 40-46. [ Links ]

Hollebeek L., Jaeger S., Brodie R., Balemi A., 2007. The influence of involvement on purchase intention for new world wine. Food Qual. Prefer., 18, 1033-1049. [ Links ]

INE. 2008. Metodología VI Encuesta de presupuestos familiares 2006-2007. Resultados Encuestas de Presupuestos familiares. Noviembre 2006 - Octubre 2007. (http://www.ine.cl/canales/ chile_estadistico/encuestas_presupuestos_familiares/2008/resultados_EPF_2006_2007_080708a.pdf). [ Links ]

Jaeger S.R., 2006. Non-sensory factors in sensory science research. Food Qual. Prefer., 17, 132-144. [ Links ]

Jarvis W., Rungie C., Lockshin L., 2003. Analysing Wine Behavioural Loyalty, International Wine Marketing Colloquium, Adelaide, July 2003. (http://academyofwinebusiness.com/wp-content/uploads/2010/05/File-015.pdf). [ Links ]

Jiménez A., García-Uriburu P., Selman S., 2010. Informe sectorial vitivinícola abril 2010. (http://www.fitchratings.cl/Upload/Sectorial%20Vitivinicola%20ABR.2010%20FINAL.pdf). [ Links ]

Johnson T., Bruwer J., 2004. Generic consumer risk-reduction strategies (RRS) in wine-related lifestyle segments of the Australian wine market. Int. J. Wine Mark., 16, 5-35. [ Links ]

Keller K.L., 2003. Strategic Brand Management: Building, Measuring, and Managing Brand Equity. 784 p. Prentice Hall, New Jersey. [ Links ]

Lange C., Martin C., Chabanet C., Combris P., Issanchou, S., 2002. Impact of the information provided to consumers on their willingness to pay for Champagne: comparison with hedonic scores. Food Qual. Prefer., 13, 597-608. [ Links ]

Ling B.H., Lockshin L., 2003. Components of wine prices for Australian wine: How winery reputation. Wine quality, region, vintage, and winery size contribute to the price of varietal wines. Australas. Mark. J., 11(3), 19-32. [ Links ]

Lockshin L., Rasmussen M., Cleary F., 2000. The nature and roles of a wine brand. Aust. NZ. Wine Ind. J., 15, 17-24. [ Links ]

Lockshin L., Hall J., 2003. Consumer purchasing behaviour for wine: what we know and where we are going. Proceedings of the International Wine Marketing Colloquium. Adelaide. (http://www.unisa.edu.au/winemarketing/conferences/proceedings.asp). [ Links ]

Lockshin L., Jarvis W., d’Hauteville F., Perrouty J.P., 2006. Simulations from discrete choice experiments to measure consumer sensitivity to brand, region, price, and awards in wine choice. Food Qual. Prefer., 17, 166-178.

Lockshin L., Mueller S., Louviere J., Francis L., Osidacz P., 2009. Development of a new method to measure how consumers choose wine. Aust. NZ. Wine Ind. J., 24, 35-40. [ Links ]

Martínez-Carrasco L., Brugarolas M., Del Campo F.J., Martínez A., 2006. Influence of purchase place and consumption frequency over quality wine preferences. Food Qual. Prefer., 17, 315-327. [ Links ]

Melo O., Buzeta J.E., Marshall M.B., 2005. Determinantes del precio del vino en el mercado chileno: un estudio de precios hedónicos. Econ. Agrar., 9, 58-73. [ Links ]

Mitchell V.W., Greatorex M., 1988. Consumer risk perception in the UK wine market. Eur. J. Mark., 22, 5-15. [ Links ]

Mora M., Magner N., Marchant R., 2010. Segmentación de Mercado de acuerdo a estilos de vida de consumidores de vino orgánico de la Región Metropolitana de Chile. Idesia, 28(3), 25-33. [ Links ] [In Spanish].

Mowle J., Merrilees B., 2005. ‘A functional and symbolic perspective to branding Australian SME wineries’. J. Prod. Brand Manage., 14, 220-227.

Mtimet N., Albisu L.M., 2006. Spanish wine consumer behavior: A choice experiment approach. Agribusiness, 22, 343-362. [ Links ]

Mueller S., Lockshin L., Louviere J., Hackman D., 2007. Do respondents use extra information provided in online Best–Worst choice experiments? Proceedings of the Xth Australian and New Zealand Marketing Academy (ANZMAC) Conference, Dunedin, New Zealand, 3–5 December 2007, 3486–3493. [ Links ]

Mueller S., Szolnoki G., 2010. The relative influence of packaging, labelling, branding and sensory attributes on liking and purchase intent: Consumers differ in their responsiveness. Food Qual. Prefer., 21, 774-783. [ Links ]

Mueller S., Lockshin L., Saltman Y., Blanford J., 2010a. Message on a bottle: The relative influence of wine back label information on wine choice. Food Qual. Prefer., 21, 22-23. [ Links ]

Mueller S., Osidacz P., Francis I.L., Lockshin, L., 2010b. Combining discrete choice and informed sensory testing to determine consumer response to extrinsic and intrinsic wine attributes. Food Qual. Prefer., 21, 741-754. [ Links ]

Mueller S., Lockshin L., Louviere J., 2010c. What you see may not be what you get: Asking consumers what matters may not reflect what they choose. Mark. Lett., 21, 335-350. [ Links ]

Myers C., 2003. Managing brand equity: A look at the impact of attributes. J. Prod. Brand Manag, 12(1), 39-51. [ Links ]

Narasimhan Ch., Wilcox R., 1998. Private Labels and the Channel Relationships: a Cross-category Analysis. J. Bus., 71, 573-600. [ Links ]

Oczkowski E., 2001. Hedonic wine price functions and measurement error. Econ. Rec., 77, 374-382. [ Links ]

Olsen J., Thach L., Nowak L., 2007. Wine for my generation: exploring how US consumers are socialized to wine. J. Wine Res., 18, 1-18. [ Links ]

Orth U.R., Malkewitz K., 2008. Holistic packaging design and consumer brand impression. J. Mark., 72, 64-81. [ Links ]

Peralta R., 2008. Diagnóstico de las legislaciones sobre indicaciones geográficas y denominaciones de origen de Centroamérica, Panamá y República Dominicana. (http://www.iica.org.gt/promecafe/publicaciones_archivos/DIGANOSTICO%20DE%20 LAS%20LEGISLACIONES.pdf). [ Links ]

Perrouty J.P., D’Hauteville F., Lockshin L., 2006. The Influence of Wine attributes on region of origin equity: An analysis of the moderating effect of consumer’s perceived expertise. Agribusiness, 22, 323-341.

Plassmann H., O’Doherty J., Shiv B., Rangel, A., 2008. Marketing actions can modulate neural representations of experienced pleasantness. Proc. Natl. Acad. Sci., 105, 1050-1054.

Priilaid D., van Rensburg P., 2010. Symbolic and functional brand effects in the hedonic assessment of South African wines. S. Afr. J. Bus. Manage., 41, 47-69. [ Links ]

PROCHILE., 2008. Estudio de mercado vino embotellado Estados Unidos. (http://www.amchamchile.cl/sites/default/files/vino.pdf). [ Links ]

Quester PG., Smart J., 1998. The influence of consumption situation and product involvement over consumer’s use of product attribute. J. Consum. Mark., 15, 220-238.

Ribeiro J., Santos J., 2008. Portuguese wine and the region of origin effect: consumers’ and retailers’ perceptions. Working Paper Series, Núcleo de Investigação em Políticas Económicas Universidade do Minho (NIPE WP 11/2008).

Richardson P.S., Dick A.S., Jain A.K., 1994. Extrinsic and intrinsic cue effects on perceptions of store brand quality. J. Mark., 58, 28-36. [ Links ]

Robinson J., 2006. The Oxford companion to wine. 800 p. Oxford University Press, Oxford. [ Links ]

Schnettler B., Rivera A., 2003. Características del proceso de decisión de compra de vino en la IX Región de La Araucanía. Cien. Investig. Agrar., 30, 1-14. [ Links ]

Schnettler B., Viñuela J.M., Sepúlveda N., 2008a. Attitude and Willingness to Pay for National and Store Brands of Milk in the South of Chile. J. Food Prod. Mark., 14(4), 76-94. [ Links ]

Schnettler B., Sepúlveda O., Ruiz D., 2008b. Aceptación diferenciada de alimentos transgénicos de origen vegetal y animal en la Región de La Araucanía, Chile. Cien. Investig. Agrar., 35, 169-180. [ Links ]

Seghieri C., Casini L., Torrisi F., 2007. ‘The wine consumer’s behaviour in selected stores of Italian major retailing chains’. Int. J. Wine Bus. Res., 19, 139-151.

Servicio Agrícola y Ganadero (SAG), 2011. Informe Ejecutivo. Producción de vinos 2011. (http://svyv.sag.gob.cl/dec_cos/inf_ej/INFORME_PRODUCCION_2011.pdf). [ Links ]

Sethuraman R., Cole C., 1999. Factors influencing the price premiums that consumers pay for national brands over store brands. J. Prod. Brand Manage., 8, 340-351. [ Links ]

Siegrist M., Cousin M E., 2009. Expectations influence sensory experience in a wine tasting. Appetite, 52, 762-765. [ Links ]

Smith D., Miltry D., 2007. Cultural convergence: consumer behavioral changes in the European wine market. J. Wine Res., 18, 107-112. [ Links ]

Spawton T., Lockshin L., 2001. Using involvement and brand equity to develop a wine tourism strategy. Int. J. Wine Market., 13(1), 72-82. [ Links ]

Sprott D.E., Shimp T.A., 2004. Using product sample to augment the perceived quality of store brands. J. Retail., 80, 305-315. [ Links ]

Thach E., Olsen J., 2006. Market segment analysis to target young adult wine drinkers. Agribusiness, 22, 307-322. [ Links ]

Troncoso J.L., Agruirre M., 2006. Demanda y oferta de vino en el período 1980-2004: un análisis econométrico. Pan. Socioec., 33, 26-32. [ Links ]

Tustin M., Lockshin, L., 2001. Region of origin: Does it really count? Aust. NZ. Wine Ind. J., 16, 139-143. [ Links ]

Varela J.A., 1991. Satisfacción/Insatisfacción de los consumidores y comportamientos postconsumo derivados. Est. Consumo., 9, 65-79. [ Links ]

Varela P., Ares G., Giménez A., Gámbaro A., 2010. Influence of brand information on consumers’ expectations and liking of powdered drinks in central location tests. Food Qual. Prefer., 21, 873-880.

Vinos de Chile, 2011. Información y estadísticas. (http://www.vinasdechile.cl/pagina/informacion-y-estadisticas/17). [ Links ]

Zamora J., Bravo M., 2005. Wine, product differentiation and tourism: exploring the case of Chile and the Maule Region. Universum, 20, 298-315. [ Links ]

ACKNOWLEDGEMENTS

The results presented are part of Fondecyt Project 1100611.

*Corresponding author: Tel: 56 45 325655, e-mail: bschnett@ufro.cl

(Manuscrito recebido em 21.12.2011. Aceite para publicação em 25.01.2012)